Texas Scorecard

Texas Scorecard A recent study of local government financial reports found Plano was the only major Texas city that entered last year’s COVID shutdowns in good fiscal health. The rest of Texas’ major cities were “sinkhole cities,” needing more money from taxpayers to pay their bills—coming mostly from growing unfunded retirement obligations. Unfortunately, last week’s statewide power outage crisis may worsen the financial health of these “sinkholes.”

In their fifth annual Financial State of the Cities report, the citizen organization Truth in Accounting (TIA) analyzed the comprehensive annual financial reports (CAFRs) of the 75 most populous U.S. cities (before the coronavirus pandemic) to determine their financial health going into 2020.

Last year, TIA found Texas itself to be a “sinkhole state,” meaning the state would have to take $11,000 more from each taxpayer to pay off all debts.

The most recent city report, published this January, was based on 2019 data.

The report included data of nine Texas cities.

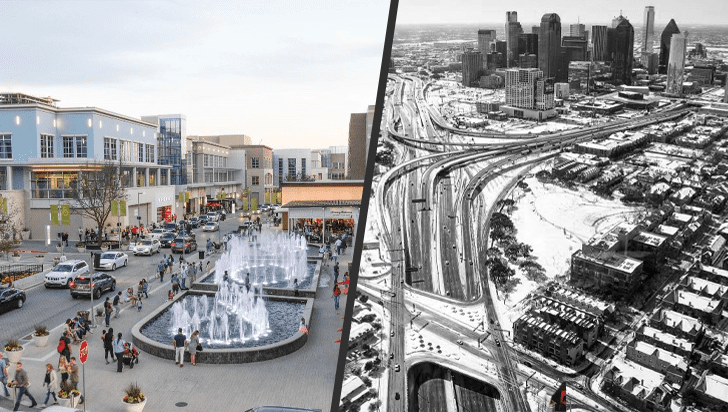

Of those, only Plano went into last year’s government economic shutdowns and restrictions in a good financial position. The city earned a B grade, qualifying for the title of a “sunshine city” (having more than enough money to pay its bills). Plano ranked ninth in the nation, with a surplus of $2,000 per taxpayer if all the city’s bills were paid.

“Unlike most cities before the crisis, Plano had more than enough resources available, $164 million, to pay all of its bills, including public employees’ retirement benefits,” TIA’s report states. “This means that Plano’s elected officials have truly balanced their budgets.”

The other eight Texas cities studied earned the title of “sinkhole cities,” meaning they didn’t have enough money to pay all of their bills and would need more from taxpayers.

Dallas earned the worst ranking, scoring 61st out of the 75 cities studied nationwide.

“Dallas’ elected officials have repeatedly made financial decisions that have left the city with a debt burden of $5.1 billion,” the report states. “Of the $10.6 billion in retirement benefits promised, the city has not funded $4.7 billion in pension and $565.4 million in retiree health care benefits.”

In 2019, Dallas had $2.79 billion to pay more than $7 billion worth of obligations. Dallas would need an additional $13,500 from each taxpayer to pay off the $5 billion-plus difference, by far the heaviest burden of Texas cities in the report. Dallas earned a D grade.

Growing unfunded retirement obligations was listed as an issue affecting the rest of Texas’ sinkhole cities, as well.

Houston earned a D grade but did slightly better than Dallas, ranking 58 out of 75 with a per-taxpayer burden of $11,600 to pay the $7 billion-plus difference between the city’s assets and liabilities.

Fort Worth, typically thought of as a Republican area, earned a D ranking and 54th place, with a $9,400 per-taxpayer burden to pay off the $2 billion-plus difference between assets and liabilities.

Austin, the Texas capital, showed a $7,600 per-taxpayer burden, followed by El Paso’s $5,200 per-taxpayer burden. Both earned a D grade.

San Antonio, with a $3,500 per-taxpayer burden, and Corpus Christi, with a $1,100 per-taxpayer burden, each earned a C.

Among Texas’ sinkhole cities, Arlington had the taxpayer burden, needing $200 per taxpayer to pay the $23 million-plus difference between city assets and liabilities. Arlington also earned a C grade.

Truth in Accounting found all