by TYLER DURDEN

By now, everyone is aware that global supply-chain congestion is off the charts and truly historic and has worsened in recent months, with 30 million tons of cargo waiting outside US ports ahead of the holiday season. But light could be emerging from the end of the tunnel, or at least peak disruption may have arrived.

“We’re through the worst of it. I think we’ve reached the peak,” said Malcolm Wilson, the CEO of GXO Logistics Inc., the world’s largest contract logistics provider that has more than 860 warehouses across the globe. “Hopefully, things will look a bit smoother as we move forward.”

GXO is a downstream player from the ports that has seen delays because of the massive backlog of container ships on the US West and East Coast ports. Wilson said, “a lot of that cargo, a lot of those products now are channeling into our warehouses.”

This is excellent news, considering the executive director of the Port of Long Beach, the largest container port in the US, recently told Americans to buy their holiday gifts now as congestion continues to build.

“Shop early because these delays and bottlenecks are going to continue to the end of the year,” Mario Cordero, the port’s executive director, said during an interview with Bloomberg Television. “Hopefully, we’ll have some strong mitigating factors.”

About 40% of all containerized goods flow through the Port of Long Beach and the neighboring Port of Los Angeles. Port congestion has hit an all-time high of around 100 vessels at terminals or waiting offshore. In pre-pandemic times, the average backlog of ships at the twin ports is between 10 and 20.

To mitigate the congestion at ports which has dragged on economic growth, President Biden issued a directive last month to operate ports on a 24/7 basis.

We recently discussed a research report from Goldman Sachs in which the bank’s economists listed what they viewed as the three critical drivers of supply chain normalization and their most likely timing:

- improved chip supply driven by post-Delta factory restarts (4Q21) and eventually by expanded production capacity (2H22 and 2023);

- improved US labor supply (4Q21 and 1H22); and

- the wind-down of US port congestion (2H22).

While some viewed Goldman’s forecast for a Q4 improvement in chip supply chains – a critical factor for renormalizing auto production – an overly optimistic US Steel CEO David Burritt said last week that “multiple auto customers, who are foreshadowing that the trough of the chip shortage could be behind us. They’re beginning to add to the fourth quarter and first quarter build schedules, and indicating to us, increasing usage rates, starting as early as next week.”

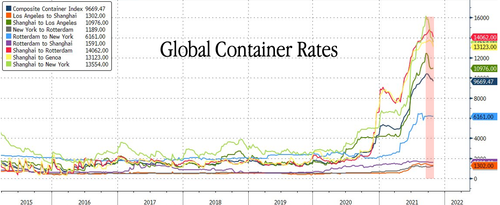

Another sign congestion at ports is waning could be global container rates on major routes have peaked. Something we discussed as early as Oct. 4 in a piece titled “Cost Of Shipping Between China And U.S. Plunges… But For The Worst Possible Reason.”

Even though the worst supply chain crisis could’ve peaked, industry experts don’t believe congestion at ports will alleviate until 2023.