by TYLER DURDEN

With the Fed supposedly telegraphing that the US economy is strong enough to withstand a modest decline in the monthly QE, China is headed in the other direction, and overnight Premier Li Keqiang said the economy faces new downward pressures and “has to cut taxes and fees to address the problems faced by small and medium-sized companies.”

While Li did not specify the extent of the new “downward pressure” or its cause, but as Bloomberg notes, the phrase is used by Chinese officials to refer to a slowing economy, which it clearly is in China as the following chart shows; he has used the phrase before, including several times in 2019.

The economy needs “cross-cyclical adjustments” to continue in a proper range, Li said during a visit to China’s top market regulator, state broadcaster CCTV reported. That phrase is associated with a more conservative fiscal and monetary approach that focuses more on the long-term outlook instead of immediate economic performance.

While Li didn’t say anything we didn’t already know (just last week Goldman cut China’s 2022 GDP forecast to just 5.2%) the premier’s admission was surprisingly candid as Beijing has traditionally been coy about revealing economic weakness. China’s economy has been slowing in recent months due to Beijing’s push to slow growth in the real-estate sector.

Li called for the creation of a better business environment through equal treatment of all types of companies and better market oversight, mentioning efforts to combat monopolies, unfair competition and hoarding. A statement from China’s government urging local authorities to ensure there was adequate food supply during the winter and encouraging people to stock up on some essentials prompted a “panic buying” scramble on Tuesday as locals rushed to hoard whatever they could, with the Ministry of Commerce later trying to calm concerns.

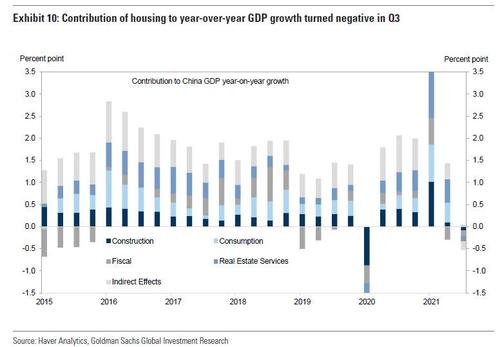

Li’s remarks came after further signs of weakness in October due to power shortages which weighed on manufacturing, and strict coronavirus controls which put a brake on holiday spending; meanwhile the unprecedented collapse in China’s housing sector is getting worse by the day (as discussed just last night in “China Junk Bond Yields Hit All Time High As Property Default Contagion Spreads, Home Sales Plunge 32%”) and the only question is how much of a hit to China’s GDP will it be. As a reminder, a little over a month ago, Goldman laid out three scenarios that saw the adverse impact on China’s GDP anywhere between 1.4% and 4.1%.

“There are no obvious growth drivers now, so the government is looking for one,” said Bruce Pang, head of macro and strategy research at China Renaissance Securities Hong Kong Ltd. “Small businesses’ investment can provide a source of healthier, longer-term growth, compared with government or property investment.”

According to Peng, in the absence of a broad-based bazooka rate cut, authorities will encourage banks to lend more to small businesses, further reduce taxes and fees for them, and look to simplify administrative procedures to encourage more entrepreneurs.

The official manufacturing purchasing managers’ index fell to 49.2, the National Bureau of Statistics said Sunday, the second month it was below the key 50-mark that signals a contraction in production.

Several investment banks have lowered their forecasts for China’s 2021 growth to below 8% in recent weeks. However, former Chinese central bank adviser Huang Yiping told Bloomberg News Tuesday that while China’s economy will slow further over the next few months, annual growth of around 8% is achievable.