by TYLER DURDEN

For the past several years, Iran has been subject to “crippling” oil-export sanctions, but that is news to China whose imports of Iranian oil have held above half a million barrels per day on average for the last three months, traders and ship-tracking firms told Reuters as Chinese buyers judge that getting crude at cheap prices outweighs any risks from busting U.S. sanctions, especially when the US president is unlikely to wake up from his afternoon nap and do anything to punish China for violating the terms of the “draconian” embargo.

Indeed, as Reuters notes, Chinese purchases of Iranian crude have continued this year despite the sanctions that, if enforced, would allow Washington to cut off those who violate them from the U.S. economy.

While normally it would be odd that a nation would so flagrantly flaunt terms of sanctions imposed by the world’s “superpower”, in this case virtually nobody bats an eyelid that Joe “10% for the big guy” Biden, whose son has long been a conduit for unofficial Chinese backchanneling to Joe; and having purchased tens of millions in family favors the White House has no choice but to look the other way and has chosen not to enforce the sanctions against Chinese individuals and companies amid negotiations that could revive a 2015 nuclear deal that would allow Iran to sell its oil openly again.

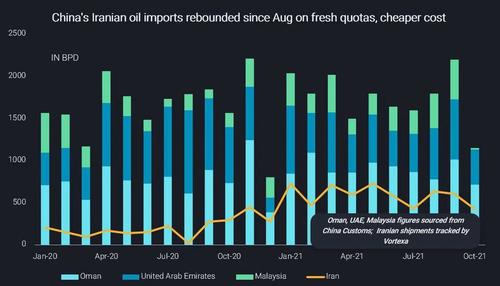

After a dip in June and July from a record high in May as buyers ran low on import permits, Chinese independent refiners embraced Iran’s cheaper crude again as the government released fresh quotas, the traders and ship-tracking sources said.

“Deep discounts of Iranian oil and the new import quotas supported demand from Chinese independent refiners,” said Emma Li, tanker tracker Vortexa Analytics’ China market analyst, adding that strong Chinese refining margins also lent support.Li also said that about 13 million barrels of Iranian oil stored in vessels off China and Singapore arrived in Shandong last month.

Prohibited Iranian oil shipments are now worth some $1.3 billion a month and the bulk of which go to China, providing key revenue for Tehran. Iran and world powers are set to resume talks on Nov. 29 to restore the nuclear deal and lift U.S. sanctions on the sales. Iranian arrivals into China hit 660,000 bpd in August and 545,000 bpd in September, before dropping back to 470,000 bpd in October, according to data from Vortexa Analytics.

That put the three-month average at 560,000 bpd, up from a 478,000 bpd average for June and July, according to Vortexa data. The shipments hit a peak of 730,000 bpd in May, while the year’s average to end-October was 562,000 bpd.

China’s June and July Iran shipments dipped as Beijing clamped down on irregular quota trading and independent refiners’ import permits dried up. In the quota interim, about 7 million barrels were moved into bonded storage between July and September, according to Vortexa and the China-based trading executive, to await Beijing’s October quota release.

These barrels were subsequently trans-shipped in October to Shandong province, China’s independent refining hub.

“Any significant improvement in the nuclear talks will lead to higher imports from Iran, although much of the volumes will first be discharged from bonded tanks,” said Michal Meidan, director of the China programme at Oxford Institute for Energy Studies. “Renewed flows from Iran are more likely next year.”

Other tanker trackers said Vortexa’s volumes for the three months are similar to their own estimates.

Daniel Gerber, Chief Executive of Petro-Logistics, said that while volumes are down from earlier in the year “going forward, if China is able to control the recent surge in COVID infections, I would not be surprised to see stronger imports from Iran, given high oil prices, OPEC discipline and the discounts that are available on sanctioned oil.”

Of course, officially China has not imported any oil from Iran since the start of 2021, according to its customs data, as state-owned refiners remain sidelined by the U.S. sanctions.

To bypass triggering US red lines, Iranian crude, which accounts for about 6% of China’s crude oil imports, is currently exported to China as oil from Oman, the United Arab Emirates and Malaysia, squeezing out supplies from Brazil and West Africa. Iranian oil was last transacted at a $4-$5 per barrel discount to Brent crude on a delivered basis, about $6-$7 below Middle East benchmark Oman, traders said.

Beijing’s acquiescence over these transactions has also emboldened traders and buyers.

“The government does not wish to intervene as it sees little downside risks allowing in these imports,” said a China-based trading executive involved in the business. In other words, China has precisely zero fear of any a forceful (or any) retaliation from Joe Brandon Biden.

China’s foreign ministry told Reuters normal business dealings between China and Iran should be respected, without going into details on shipments. “China urges the U.S. to lift the illegitimate unilateral sanctions as soon as possible,” the ministry said.

Meanwhile, making a further mockery of the feeble old man in the White House, a senior U.S. official told Reuters that Washington is aware of China’s Iranian oil purchases, and has chosen diplomacy as a “more effective path forward to address our concerns”.

Said otherwise, the US will punish countries who violate its sanctions, but it won’t dare touch China as it itself is too afraid of what an escalation could look like.