by TYLER DURDEN

There was some speculation today that the long-awaited SEC decision on a futures-based bitcoin ETF was imminent, which is what sparked the earlier surge in the crypto sector. Said speculation got only stronger after earlier in the day, the SEC tweeted out an education bulletin the agency wrote in June about bitcoin futures and “funds that hold bitcoin futures.” As Bloomberg’s resident in house crypto expert put it, this was “clearly good sign and we upping our [bitcoin ETF] odds to 85% but until I see ProShares’ updated post-effective prospectus his EDGS, I’m not calling it.”

GETTING CLOSER: The SEC just tweeted out an edu bulletin they wrote back in June re bitcoin futures and "funds that hold bitcoin futures" Clearly good sign and we upping our odds to 85% but until I see ProShares' updated post-effective prospectus his EDGS, I'm not calling it. https://t.co/LJ6Kf4wPZm

— Eric Balchunas (@EricBalchunas) October 14, 2021

He probably should have called it because late on Thursday, Bloomberg reported what so many crypto faithful had been waiting for the past 7 years, namely that the SEC is “poised to allow the first U.S. Bitcoin futures exchange-traded fund to begin trading in a watershed moment for the cryptocurrency industry.”

According to the report, the SEC isn’t likely to block the products from starting to trade next week. Furthermore, as reported previously, unlike Bitcoin ETF applications that the regulator has previously rejected, “the proposals by ProShares and Invesco Ltd. are based on futures contracts and were filed under mutual fund rules that SEC Chairman Gary Gensler has said provide “significant investor protections.”

So barring “a last-minute reversal”, the fund launch will be the culmination of a nearly decade-long campaign by the $6.7 trillion ETF industry to begin allocating some capital to the best performing asset class/currency/commodity of the past decade.

Advocates have sought approval as a confirmation of mainstream acceptance of cryptocurrencies since Cameron and Tyler Winklevoss, the twins best known for their part in the history of Facebook Inc., filed the first application for a Bitcoin ETF in 2013.

The long wait is coming to a favorable outcome after years of stumbles with the SEC previously rejecting bitcoin ETF on the grounds that the crypto space is plagued with investor hazards. The SEC had also expressed concern that prices could be manipulated and liquidity might be insufficient, and that Bitcoin’s drastic price swings may be too much for individual investors. Of course, for most investors the volatility is worth the returns: Bitcoin’s last three full-year returns were a 74% loss followed by gains of 95% and 305%. Additionally, the SEC has questioned whether funds would have the information necessary to adequately value cryptocurrencies or related products. There have also been questions about validating ownership of the coins held by funds and the threat from hackers.

But the mood shifted in August, when Gensler – who previously showed extensive interest in the crypto world having once taught a class at MIT’s Sloan School of Management called “Blockchain and Money” – signaled he’d favor funds based on CME-traded Bitcoin futures filed under a 1940s law. He reiterated that stance late last month.

Gensler’s openness led to a wave of futures-backed filings and unbridled optimism among issuers that approval could be imminent, and helped lift the price of bitcoin from the low/mid-$40,000s to above $50,000 in recent days, surging to its highest level since May this week, ultimately doubling from its price reached in late July when it briefly dipped below $30,000.

That said, the initial capital reallocation will likely be modest. According to Balchunas, such futures-based ETFs are “flawed because rolling futures and will prob not sweep the nation.” His guess is only. 3-4b in first year (1% of ETF flows).” But, in any event, this is “def a BIG step after 7yr wait.”

Most ppl reading this thread from crypto world are prob pumped but just note these ETFs are flawed bc rolling futures and will prob not sweep the nation, rather demand prom muted. My guess is only. 3-4b in first year (1% of ETF flows). But def a BIG step after 7yr wait.

— Eric Balchunas (@EricBalchunas) October 15, 2021

Balchunas also made a prediction which Bitcoin ETF will get to the market first, a list which is headed by the ProShares Bitcoin Strategy ETF and goes from there.

And once again here’s our odds on which Bitcoin ETF gets to market first as well as first poss date they can launch, via @JSeyff pic.twitter.com/GqXRf2O5oM

— Eric Balchunas (@EricBalchunas) October 15, 2021

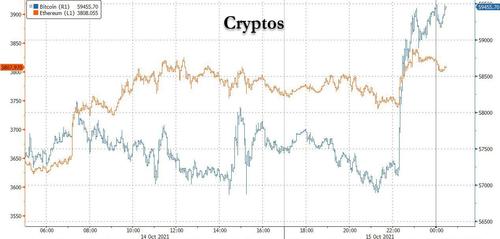

News of the imminent bitcoin ETF sent bitcoin and the broader crypto space sharply higher when it hit just after 10pm ET on Thursday.