This could be the start of a problem…

Overheard at The Treasury…

Stocks were mixed today with Nasdaq lagging and Small Caps leading. The usual chaos hit as the cash markets opened, Nasdaq decoupled (bearishly) as rate rose and then an ugly 20Y Auction spooked all stocks around 1300ET. There was no significant dip-buying off that dip and overall the market faded into the close…

The Dow and S&P pushed back up to their record highs but could not extend…

Value outperformed Growth today catching up on the week…

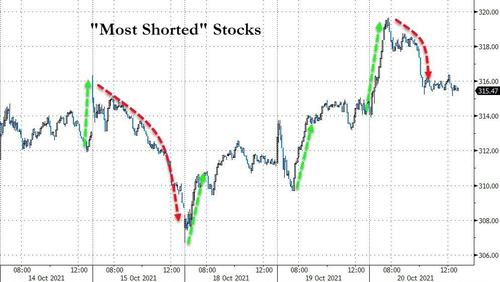

Once again, shorts were squeezed at the open but this time theu quickly ran out of steam…

Treasuries were mixed once again, extending yesterday’s trend with the short-end bid and long-end offered (2Y -2bps, 30Y +3bps)

The yield curve (5s30s) steepened further today, erasing Friday/Monday’s flattening (but seemed to stall at resistance there)…

The dollar continued its downward trajectory, falling to its lowest in a month…

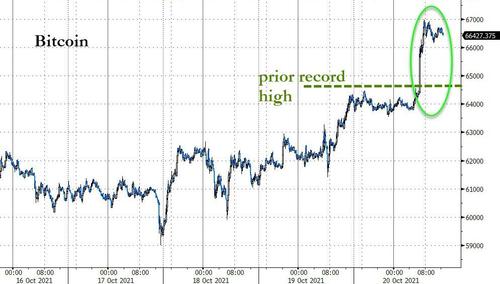

But Cryptos were the headline-grabbers of the day as Bitcoin ripped to a new record high today…

…tagging $67,000 intraday…

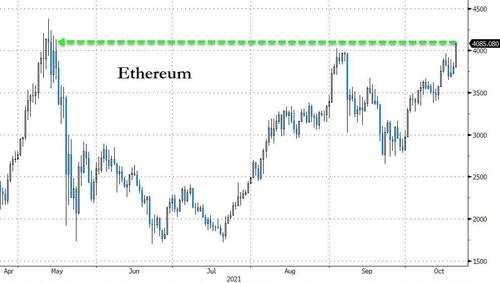

Ethereum is back above $4000, taking out early Sept highs back to the highest since May…

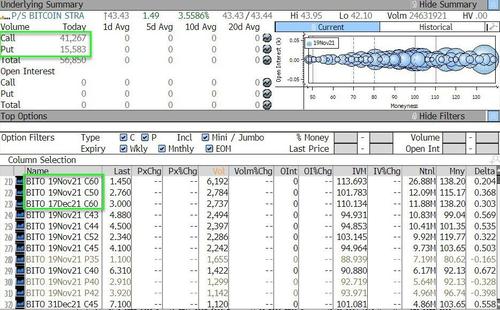

BITO options volumes were dominated by short-dated deep OTM calls (gamma squeezing) with call volumes almost triple those of puts…

As BITO’s price soared and it achieved $1bn in AUM in 2 days – which has never been done before…

Gold was also bid today as the dollar dropped…

WTI ramped to new cycle highs today after yoyo-ing around after API and DOE inventory data…

Copper rebounded after yesterday’s efforts by LME to tamp down the backwardation…

Finally, Greed is back…

And Puts are hated…

“Probably nothing…”