By Tyler Durden

Wall Street analysts have been churning out commentary this week proclaiming that while Evergrande’s troubles pose a serious threat to the Chinese economy, it’s potential collapse doesn’t represent a “Lehman Moment”. As Thursday’s bond-interest deadline looms, analysts at Mizuho write that “while street wisdom is that Evergrande is not a ‘Lehman risk’, it is by no stretch of the imagination any meaningful comfort…It could end up being China’s proverbial house of cards … with cross-sector headwinds already felt in materials/commodities.”

We touched on this earlier, with analysts at SocGen raising the odds of a “hard landing” – an “extended, severe property-led slowdown” – to 30%.

The FT, meanwhile, shared Barclays’ skeptical take on the Lehman scenario comparisons, arguing that Evergrande has little in common with the Lehman scenario aside from the timing (Lehman famously filed for bankruptcy in September 2008, 13 years ago.

“China’s situation is very different. Not only are the property sectors’ linkages to the financial system not on the same scale as a large investment bank, but the debt capital markets are not the only, or even the primary, means of funding. The country is, to a large extent, a command-and-control economy. In an extreme scenario, even if capital markets are shut to all Chinese property firms (which is not occurring and is only a tail risk at this point), regulators could direct banks to lend to such firms, keeping them afloat and providing time for an extended ‘work-out’ if needed. The only way to get a widespread lenders’ strike in a strategically important part of the economy would be if there were a policy mistake, where the authorities allow the chips to fall where they may (perhaps to impose market discipline), regardless of the systemic implications. And we think that’s very unlikely; the lesson from Lehman was that moral hazard needs to take a back seat to systemic risk.”

And while that might sound reasonable enough, one of the world’s richest bankers, Uday Kotak, the CEO and founder of Indian lender Kotak Mahindra Bank, begs to differ. He said in a tweet on Tuesday that Evergrande “seems like China’s Lehman moment.”

Evergrande seems like China’s Lehman moment. Reminds us of IL&FS. Indian Government acted swiftly. Provided calm to financial markets. The Government appointed board estimates 61% recovery at IL&FS. Evergrande bonds in China trading ~ 25 cents to a $.

— Uday Kotak (@udaykotak) September 21, 2021

Kotak also likened the crisis at Evergrande to the collapse of India’s Infrastructure Leasing & Financial Services Ltd. The Indian government chose him to oversee the restructuring of the distressed shadow lender three years ago after it defaulted on debt repayments.

On Tuesday morning in New York, news that Evergrande had missed payments due Monday to at least two banks hit – not that this is such a surprise. The expectation is that the developer is suffering from a liquidity crisis that has left it unable to make payments on any of its massive $300BN+ debt pile.

Amid all the chaos, Chinese markets have been closed Monday and Tuesday for China’s mid-autumn festival. To try and keep the company’s employees from walking out, Evergrande’s chairman, Hui Ka Yuan, said China’s biggest property developer would “walk out of its darkest moment” and deliver on its commitments. The letter was billed as an update to coincide with the holiday.

Markets Insider translated the letter, which can be found below:

Dear department leaders and colleagues,

I am sending my sincerest well-wishes to you on the occasion of the Mid-Autumn Festival. May you and your families have a happy holiday, and stay safe and healthy. My sincerest regards to all our employees who are still fighting on the frontlines for our re-opening and resumption of production!

At the moment, our company has encountered an unprecedented and mammoth difficulty. As a whole, our staff has also experienced a challenge they have never seen the likes of. The members of our leadership team have surmounted every difficulty, making a brave stand for their teams, and working night and day. They are the pillars that protect and ensure our company’s stability. Here, I extend my deepest gratitude to all of you. I also thank your families, who have supported you and made silent sacrifices — they have my greatest respect.

I have always been proud of our company’s army of loyal, immensely hardworking staff, who persevere regardless of gains or losses. I firmly believe that Evergrande employees never yield, are never defeated, and only grow stronger in adversity. This is the greatest source of power that we have to overcome all difficulties and win this war.

I further believe that through the collective work of our leadership team and all our employees — if we continue to fight, and persevere through this struggle — we will walk out of the darkness soon.

If we do this, we’ll be able to push toward a complete reopening and fulfill our promise to guarantee that properties reach the hands of our buyers. We will also be able to account to home buyers, investors, our collaborators, and financial institutions, with a solid response — that we are responsible, and can shoulder this burden.

If we are united, we can move mountains! My colleagues, let’s unite and demonstrate courage in the face of a hundred adversities, and a tough, solid spirit. Let us fulfill with all our strength the responsibility we have to our society, and build a better future together!”

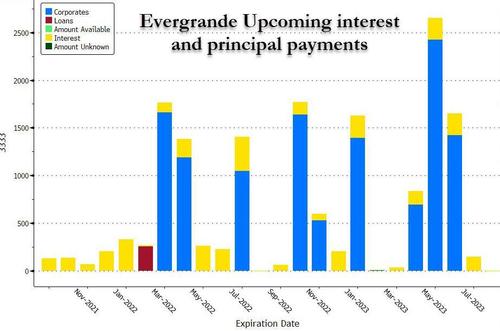

With Evergrande expected to miss the next round of payments on Thursday, here’s a reminder of how its contagion might spread throughout the global financial system.

As for the payments missed yesterday, Evergrande hadn’t made them as of late Tuesday local time, a handful of anonymous sources told Bloomberg. Banks were expecting Evergrande to miss the deadline after China’s housing ministry told them the company would be unable to pay on time.

Now, it’s unclear whether banks will formally declare Evergrande in default. Some are waiting for the developer to propose a loan extension plan before deciding on next steps. Or perhaps for Beijing to step in and save the day, something top Chinese officials have suggested won’t be happening this time around.