by TYLER DURDEN

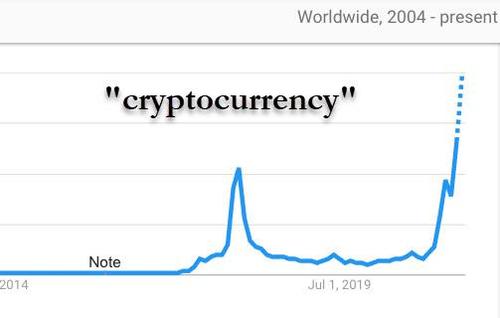

In the immediate aftermath of the crypto crash, which made bitcoin and its peers the main talking point amid trading desks as well as the general public, with google searches for cryptocurrency hitting an all time high on Wednesday…

.. at 2pm today Fed Chair Powell reminded the peasantry that the Federal Reserve itself is planning on rolling out its own CBDC, i.e., a digital dollar, and announced that the Fed plans to publish this summer a discussion paper “that will explore the implications of fast-evolving technology for digital payments, with a particular focus on the possibility of issuing a U.S. central bank digital currency.”

“As the central bank of the United States, the Federal Reserve is charged with promoting monetary and financial stability and the safety and efficiency of the payment system,” Federal Reserve Board Chair Jerome H. Powell said Thursday in a video message. “In pursuit of these core functions we have been carefully monitoring and adapting to the technological innovations now transforming the world of payments, finance, and banking.”

“We are committed at the Federal Reserve to hearing a wide range of voices on this important issue before making any decision on whether and how to move forward with a U.S. CBDC,” he said in a statement Thursday, referring to central bank digital currencies.

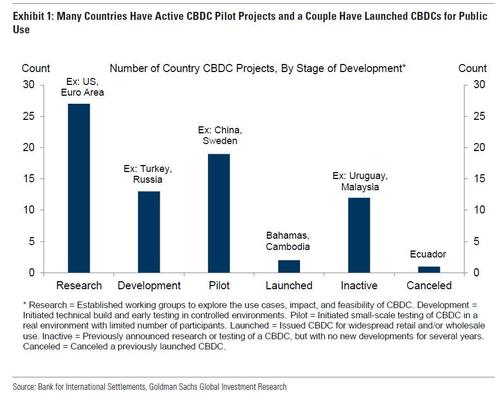

Powell also made it clear that he wants the Fed to play “a leading role” in the development of international standards. Central banks around the world – most notably the People’s Bank of China – are moving ahead with digital currencies which could give them a head-start in how standards develop, according to Bloomberg. Indeed, the chart below shows the number of country CBDC projects by stage of development.

The announcement, which comes as China launches its own digital yuan which however has emerged as one giant flop, and during a week of intense volatility in cryptocurrencies, marks a shift in momentum on the CBDC topic at the Fed, which until now has mostly been a technological research project at its regional branch in Boston.

A key issue for Powell and other Fed officials is how such technology would fit into the current U.S. banking system, which already deals with electronic payments in a variety of ways. Critics of the current system say it locks out many low-income people and charges them fees for basic services that people with high account balances don’t suffer. Digital currency accounts held by individuals could serve as a form of competition. Still, the banking system offers high protection for depositors, including insurance, that a less regulated system may not offer.

“Our key focus is on whether and how a CBDC could improve on an already safe, effective, dynamic, and efficient U.S. domestic payments system,” Powell said adding that “it is important that any potential CBDC could serve as a complement to, and not a replacement of, cash and current private-sector digital forms of the dollar, such as deposits at commercial banks. The design of a CBDC would raise important monetary policy, financial stability, consumer protection, legal, and privacy considerations and will require careful thought and analysis—including input from the public and elected officials.”

Translation: the financial system is on the verge of collapse and only the ramming through of programmable digital dollars, which can be turned off and expire at the push of a button as well as devalue themselves under a negative rates environment, can save it. Oh, and in a sequel to FDR’s Executive Order 6102, the government will confiscate all your physical cash (and precious metals) and replace it with digital bux.

Despite implicitly admitting that the digital currency revolution started by bitcoin has changed the world, and is about to change accepted money forever, Powell took the opportunity to bash true digital currencies. The Fed chair said that “to date, cryptocurrencies have not served as a convenient way to make payments, given, among other factors, their swings in value.”

Which is news to anyone who bought crypto several years ago and held, or anyone for that matter who bought bitcoin prior to March: they have not only preserved their value but seen their wealth explode.

What was perhaps more notable was Powell’s far more supportive view of stablecoins:

… coins tied to the value of the dollar or another currency—known as “stablecoins”— have emerged as a new way to make payments. These stablecoins aim to use new technologies in a way that has the potential to enhance payments efficiency, speed up settlement flows, and reduce end-user costs—but they may also carry potential risks to those users and to the broader financial system. For example, although the value of a stablecoin may be tied to the value of a dollar, these coins may not come with the same protections as traditional means of payment, such as physical currency or the deposits in your bank account. Therefore, as stablecoins’ use increases, so must our attention to the appropriate regulatory and oversight framework. This includes paying attention to private-sector payments innovators who are currently not within the traditional regulatory arrangements applied to banks, investment firms, and other financial intermediaries.

This comment from Powell is quite bullish for stablecoins such as Facebook’s Diem, as well as Silvergate – the bank which the social network recently announced it would partner with in issuing the Facebook stablecoin, the DiemUSD.

As for Powell’s expectations for the upcoming CBDC paper, he said it would represent a thoughtful process. “Irrespective of the conclusion we ultimately reach, we expect to play a leading role in developing international standards for CBDCs, engaging actively with central banks in other jurisdictions as well as regulators and supervisors here in the United States throughout that process.”

Powell’s transcript below.