www.aier.org

www.aier.org By Sandy Szwarc

The extreme and continued Covid-19 government mitigation mandates are unprecedented for any respiratory virus in our history. The economic consequences of these directives – masks; social distancing; testing, tracking and quarantines; travel, school and business restrictions − have led to historic levels of job losses and failing businesses. People looking for work have been crippled from finding jobs. Tens of millions of Americans are at risk of losing their group health insurance. As Americans grow increasingly more desperate, the government continues to restrict peoples’ options.

The CARES Act epitomized the tenet of redistribution of wealth, growing the numbers of Americans dependent upon the government, and vastly increasing the size and power of government.

The CARES Act is a microcosm of Obama-era entitlements

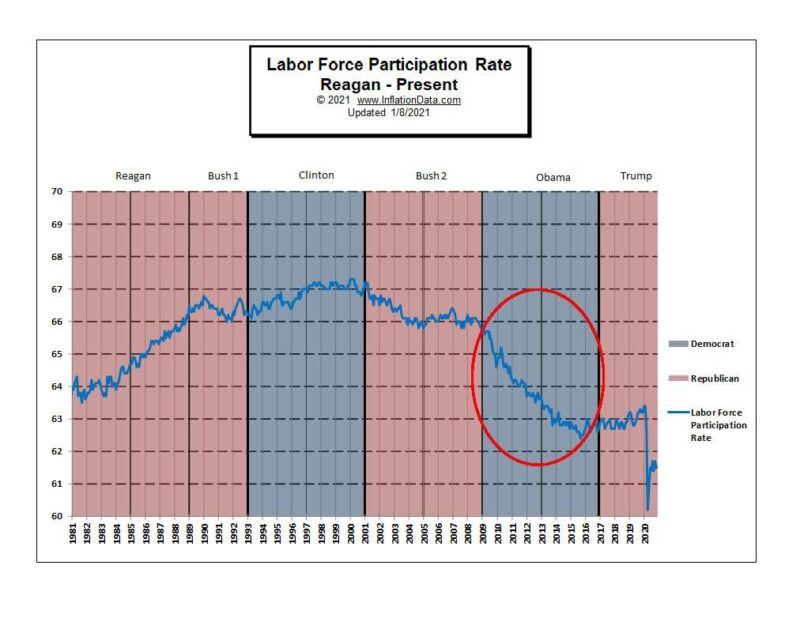

To better understand what is happening today, it’s helpful to look back. The Obama Administration’s policies succeeded in the most drastic reduction of Americans participating in the workforce of any President in half a century. For the first time, the fairly steady gains in the number of working Americans were wiped out to below levels of the late 1970s.

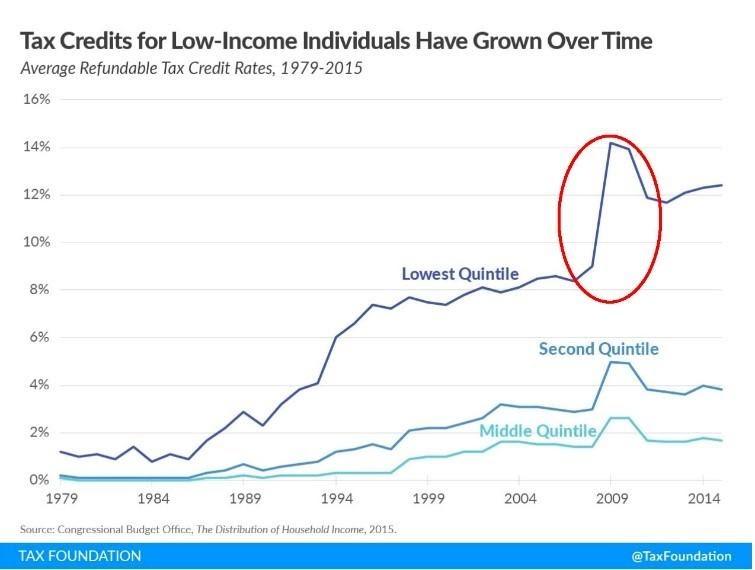

Simultaneously, the percentage of Americans not paying any taxes at all jumped to an historic high of 49.5 percent in 2009, and tax credits given to low-income individuals jumped to over 14 percent, according to IRS data reported by the Tax Foundation. Fewer and fewer Americans were left to pay a greater share of the tax burden.

Obama’s legacy was $5 trillion in new government programs, including the Affordable Care Act (often referred to as “Obamacare”), cuts to Medicare, and steep tax increases, along with an unsustainable surge of entitlement programs that was to bring a” future entitlement Armageddon,” according to the Manhattan Institute analysis.

During Obama’s Administration, a record number of Americans went on government assistance, transforming the country into an entitlement society and a lifestyle of dependency.

- Participation in food stamps, for example, saw its greatest increase under Obama, increasing to the highest levels in history. He was given the title “food stamp President” by Nancy Pelosi, as a badge of honor. The USDA has been tracking participation in the food stamp program since 1969, when average participation was 2.9 million. During Obama’s first term, the rosters increased 49 percent to 47.5 million people – an increase of 11,133 people per day. Economic factors didn’t fully explain the surge in food stamp participation, according to the USDA. The program was made easier to apply for, and the benefits more generous, to encourage enrollment.

- Under Obamacare, Medicaid benefits and eligibility were expanded, increasing spending 73 percent and accounting for the largest growth in Federal spending to states, according to PEW Charitable Trusts. By 2016 at the end of his term, over 74 million Americans were on Medicaid − 13 million more than when Obama took office.

A special report from the Heritage Foundation revealed that government dependency in America reached the highest in the country’s history, growing 8.1 percent in 2010 alone, with 70.5 percent of federal spending on entitlement programs.

But Obama’s impact was paled by the government’s Covid-19 mandates. Covid-19 policies would destroy the workforce and open the door to expanded government entitlements, making more Americans dependent on the government, as never before imagined.

The full picture of the destruction of the economy and job losses resulting from the government Covid-19 mandates is vastly more significant than the media has portrayed.

Workforce participation. At the beginning of 2020, before the government declared the Covid-19 pandemic and enacted its unprecedented emergency declarations, 95 million Americans were not in the workforce. But that number jumped by more than 10 million in a single month after the emergency declarations. With the continued lockdowns and emergency orders, millions of Americans have had to drop out of the labor force, needing to care for elderly parents or children, or have been unable to find jobs in the bleak job market. The number of Americans not in the workforce had risen to over 100.6 million Americans by November, according to the U.S. Bureau of Labor Statistics.

This was the lowest participation in the workforce that our country has seen in 50 years.

The magnitude of job loss after the government issued its pandemic declarations “had no precedent since the end of World War II,” said the BLS. Never before in history has the majority of unemployed workers been laid off, it reported. More than twice as many jobs were lost during just the first two months under the pandemic emergency actions than were lost during the entire three years of the Great Recession (2007-2009).

As the pandemic declarations continue, the economic and societal damage has continued, said the BLS. There is an enormous body of evidence that shows these forms of economic damage heal slowly, it reported. High rates of unemployment are linked with slow hiring and layoffs. “It took more than five years for the labor market to recover after the end of the Great Recession.” As jobs shift from productive work to services, the economy is weakened and recovery from any downturn is predicted to be even slower and prolonged, according to the BLS.

Yet, our post-Covid-19 clock won’t even start until the country is back to a real normal, making today’s dark reality feel even more dire for untold numbers of Americans.

Along with the poor economy, the real GDP through the end of 2021 was predicted by the Congressional Budget Office to be well below its original projections and below pre-pandemic levels. It now projects a federal budget deficit of $3.3 trillion for 2020, more than triple that in 2019, because of the legislative actions in response to Covid-19 and the economic disruptions.

The greatest numbers of unemployed Americans, about 4 million, have already been without work for seven or more months according to the BLS. And 6.7 million have only been able to find part-time work due to the economy, jobs that offer no benefits.

Women. Women have been especially affected, with 19 million more women than men not working, either unable to find jobs or unable to work. Women have been particularly hurt during the pandemic job market, as they are most often caretakers of family members in poor health, elderly parents and children out of school, according to the December 2020 of the BLS Monthly Labor Review. No matter what their education, level of job skills or income, women have been the hardest hit by the pandemic government actions, adversely affecting every measure of physical and mental health, personal life, pay, job security and finances, BLS reports.

Older Americans. Since the 1990s, older workers began to increase their share of the workforce while younger workers declined. This fact is rarely recognized by the media. The labor force participation rate has been increasing fastest among older workers, ages 65-75 and older, according to the BLS and this trend is expected to continue through 2024, with the growth of older workers projected to increase faster than any other age group. Many baby boomers keep working for a number of reasons. They are healthier and have a longer life expectancy than the previous generation, and are better educated and have value, experience and work ethics to offer employers, keeping them in the workforce. Changes to benefits bring the need for more income and to save more for retirement. Losing their job and employer group health plan can be especially serious for older workers.

Unemployment. The unemployment rate also doubled literally in the weeks of pandemic emergency mandates, rising to more than 10 percent of Americans. It has continued at historic levels, double pre-pandemic levels.

The latest Department of Labor News Release reported that new unemployment claims filed in State programs this year have increased every week in January − to 868,000 on January 23. These numbers are 308 percent higher than the same month last year (212,750) before pandemic emergency actions. Federal employees on unemployment assistance add another 426,856 Americans, 49 percent higher than last year.

A total of 18.3 million Americans are receiving unemployment benefits under State or federal programs − 742 percent more than a year earlier (when the total was 2.1 million), according to the BLS. While they’re being helped by unemployment checks, the media is overlooking their lost health insurance…which can be a much bigger concern and a matter of life and death.

After a year of declining job growth during Covid-19 restrictions, including 227,000 jobs lost this past December alone, a first time increase of 43,000 in government jobs and 6,000 private sector jobs was reported for January of this year. To put this meager number into perspective, the U.S. gained 312,000 jobs just in the month of December 2018, capping the biggest increase in hiring in three years and showing the second longest economic expansion in U.S. history.

Employer group health insurance. Prior to pandemic declarations, two-thirds of Americans were covered under employer group plans, either actively employed or transitioning between jobs and keeping their insurance through continuation of benefits (COBRA). Employer commercial group plans are the most popular health coverage. The vast majority of people like their employer group plans, Kaiser reported. It’s the most valued worker benefit. An America’s Health Insurance Plan survey found that 71 percent of Americans like their coverage and stated their group plan was the biggest factor for staying at their jobs. Workers have recognized that their employer is able to negotiate and offer the best possible deals for healthcare coverage, no matter what type of group plan they’ve chosen.

Suddenly, in just the first two months of emergency declarations, nearly 78 million people were in households suffering a job loss, according to Kaiser. It estimated that by May, 26.8 million people lost their employer health insurance coverage. Most workers, especially older workers or those with family members or children facing serious illnesses or conditions, did everything possible to continue their coverage through COBRA. Those who couldn’t, or who now face their COBRA benefits running out, were thrust into the government-regulated ACA marketplace and onto government plans, such as Medicaid or Medicare, against their will. They were left with no other choice.

Nearly 7.5 million American workers lost their commercial health insurance coverage between April and May, according to the Alliance to Fight for Health Care. Nearly all of those individuals with commercial health insurance were not participating in Obamacare’s ACA Health Insurance Marketplace (commonly referred to as “The Exchange”). Nor did most want to.

Enrollment in the ACA marketplace has been dropping continually since 2016. Last January 2020, before the Covid-19 mandates, enrollment was down more than 150,000 compared to 2019. Over the previous three years, 1.2 million Americans had left the Exchange. The Centers for Medicare & Medicaid Services (CMS) Administrator called the Exchange a “failed experiment” and the Affordable Care Act “fundamentally broken and nothing less than wholesale reforms can fix it.”

Creating job losses and economic crisis is a proven way to increase the number of Americans on ACA and government managed health programs. It is well known that during economic downturns, enrollment and spending in Medicaid grows, as more people lose jobs and income, said Kaiser Family Foundation. But even the government’s Covid-19 emergency mandates failed to increase overall enrollment in the ACA Exchange during 2020, according to CMS.

The longer and more severe the economic devastation and the more dire the job market, the more desperate people become and the fewer choices they are left with. Kaiser estimated that as economic situations become increasingly more grim with continued pandemic government policies, about 23 million Americans who’ve not been able to find work by January 2021 will become eligible for government-subsidized coverage − 17 million to Medicaid and 6 million to ACA marketplace subsidies.

This is as intended.

Seldom mentioned is that a major goal of Covid-19 government policies is to eliminate private and group health plans and force more Americans onto government managed care, be it Medicaid, Medicare, or the ACA Exchange. One can argue semantics, but that’s socialized medicine.

The repercussions for workers being thrust into the marketplace are enormous: It means being forced onto health care managed by the government.

The greatest danger in losing employee health coverage is that it means losing the last and only remaining way hard working Americans have to keep autonomy over their medical care and their healthcare decisions.

Workers are losing their group PPO plans. On the individual marketplace, there is no PPO plan available. PPO plans are those that allow you to be in charge of your medical care, when and which doctor or specialist you visit, and gives more out-of-network options for care providers. Unlike managed care, you don’t have a gatekeeper you must see first, who decides if and which doctor or specialist you will be allowed to see and what tests, medications and treatments you will be permitted to receive. While PPO plans are still rife with government ACA regulations, under a PPO plan, you and your doctor are more in control of your medical treatment, there are far more choices of doctors and hospitals, many more treatments and medications are covered, and premiums and out-of-pocket expenses are much lower than on government managed care plans.

The most perilous dangers of losing employer health coverage come if an employee or their family member faces a serious or catastrophic medical issue and need specialized, long-term or expensive medicines or care. And that’s the real reason we all need good insurance, isn’t it? Very few Americans are so wealthy they can do without insurance and pay cash for such unforeseen expenses.

In the marketplace, the only option for individuals looking for health insurance plans is an ACA-compliant managed care plan, which are all virtually identical because they are regulated under ACA. And for those under certain income thresholds, they’ll automatically be put on Medicaid managed care. Under government managed care plans, a third party with vested interests manages you and your care, gives the federal government control over the practice of medicine, and even limits what your doctor is allowed to offer.

As well, managed care under the government and third-party providers has also forced troubling changes in medical ethics – medical professionals are no longer able to be guided by the Hippocratic Oath, and acting in their patient’s best interests, or their own consciences. Instead, they must answer to political and economic interests. You and your doctor will be governed, “managed,” by a third party – an entity with vested interests that are not what is best for you, but for them.

Being thrust onto the marketplace is the greatest risk, and most life-threatening, for workers age 65+.

NO commercial individual insurance plan can be purchased in the entire country by anyone 65 years+. Simply because of their age, seniors are not allowed to purchase health insurance plans like everyone else. They are forced into compulsory Medicare government-managed care. And once on, they can never get off.

As any experienced and educated healthcare professional knows, and which the medical literature has covered extensively for decades, Medicare and government-managed care can be a death sentence for seniors.

Nowadays, more seniors are working well past age 65, and are choosing employer group health plans specifically in order to stay off Medicare, recognizing that group commercial plans offer better coverage, more care options, and much better affordability than Medicare:

- Premiums in employer group plans are significantly lower than Medicare Part B, along with supplemental plans and Part D.

- Many more types of care are covered under commercial group plans − care that’s restricted or denied under Medicare Part B.

- Even if recipients were financially able, seniors are prohibited from paying privately for care that is not covered under Medicare Part B; and medical providers and healthcare systems are forbidden from providing noncovered care to a Medicare eligible patient.

- Many more doctors and healthcare providers are available under commercial group plans. It’s increasingly difficult to find Medicare providers, resulting in ex-facto lack of care.

- Even seniors on Medicare who got Covid-19 faced huge bills for care due to high out-of-pocket expenses, copays and deductibles, with no out-of-pocket limits.

For seniors facing catastrophic diagnoses, Medicare is especially devastating.

- Medicare Parts B and D have no out-of-pocket limits, making costs for medical treatments and medicines unattainable. Even Medicare Advantage plans no longer cap out-of-pocket drug costs. Since 2010, Medicare Part D has nearly doubled the number of generic drugs moved to higher priced specialty drug tiers, raising out-of-pocket costs even further. Last November, Health Affairs reported that out-of-pocket costs for specialty medications for seniors on Medicare Part D had tripled between 2010-2017.

- Medicare patients face a 5 percent copay for oral specialty medications at the catastrophic coverage with no out-of-pocket limits; and injectable specialty medications have a 20 percent copay with no out-of-pocket limits. This is especially life-threatening for seniors with cancer, multiple sclerosis, hepatitis, rheumatoid arthritis, diabetes, and other serious diagnoses who reach the catastrophic threshold quickly, according to a Kaiser Issue Brief.

- Median annual out-of-pocket costs for Part D enrollees are over $12,000 for Revlimid, a recommended maintenance drug for multiple myeloma, and over $14,000 for Idhifa for leukemia, for example.

- But increasingly, Medicare Part D is not covering needed specialty drugs at all, forcing seniors to pay the total cost. Kaiser found more than half of the specialty drugs they studied weren’t covered by all plans, leaving some seniors with median out-of-pocket costs in the six figures, “amounts that exceed the limits of affordability for the vast majority of Part D enrollees.”

- Compounding the financial toll, Medicare recipients are not able to get the discounts and free/reduced benefits from pharmaceutical companies that are available to commercial group plans, as it was made illegal to “negotiate drug prices” under Medicare.

Many illnesses, disabilities and cancers primarily affect the elderly, as they are diseases of aging. In contrast to pop beliefs, no amount of “healthy eating” or following some ideal lifestyle can prevent them. Yet, the cruelty of blaming people for getting cancer, heart disease, Alzheimer’s, or some other age-related disease continues. Those most in need of real medical care find it unattainable for them. Medicare doesn’t cover many of the treatments that can add years to their lives or improve their quality of life and relieve pain…treatments that are available to patients with non-governmental insurance. It’s impossible to explain in simple words the silent suffering and hardships endured by the elderly, who should be valued and cared for.

Workers who were on COBRA when the pandemic hit, or signed up for COBRA after losing their jobs and employer health coverage, find their COBRA benefits about to expire. The situation is desperate for many. Government plans are not an option for those with certain conditions. They face having no health insurance and needing to come up with the money to keep themselves or a loved one alive. The emergency declarations themselves could be made a “qualifying event” to extend COBRA coverage, but no one is talking about that. Only Covid-19 patients matter. To continue coverage for a family member on their plan who is facing a catastrophic diagnosis, workers unable to find a job in this pandemic job market are left with only one option to extend COBRA, under current regulations. They, themselves, must die.

When will it end?

Last spring, the Congressional Budget Office estimated that high unemployment rates will continue through the end of 2021, about six percent higher than it had originally predicted last January, along with about 6 million fewer people participating in the workforce. Nearly all states anticipated higher numbers of people enrolled in government-managed Medicaid through 2021, according to a survey conducted last spring by the Kaiser Family Foundation and Health Management Associates.

But these projections are proving optimistic. The public is finally coming to realize that there is no end in sight in the government’s plans to never allow the country to return to normal in the foreseeable future. The fact that herd immunity, from natural immunities preexisting from past coronavirus infections and people who’ve already had the virus, is making the pandemic mandates and the “vaccine” increasingly less critical, is being ignored.

Now, even the “vaccine” won’t allow life or business to return to normal. Anthony Fauci has threatened that government mitigation measures will last two years, continuing into 2022; some academics have advocated for mandates to continue years until the virus is completely eradicated (which will be never, as most coronaviruses become endemic and part of the mix of seasonal viruses we have every year, and resemble the common cold); and despite the fact that the World Health Organization advises against mask wearing among the general public, stakeholders are saying that normal life (without masking, social distancing and other restrictions) won’t be permitted until after 2022, even after “lockdowns” are lifted.

All of this means that the projected economic and job recovery may not even begin until after 2022, at the earliest. Jobs and employer health insurance coverage will continue to be razed and more people forced onto government-managed care. No one is talking about the even larger underlying motives for all of this. The clue is in what is happening to the weakest and most vulnerable among us: the elderly, the sickest and the disabled. If this sounds like eugenics, it is.