Our Finite World

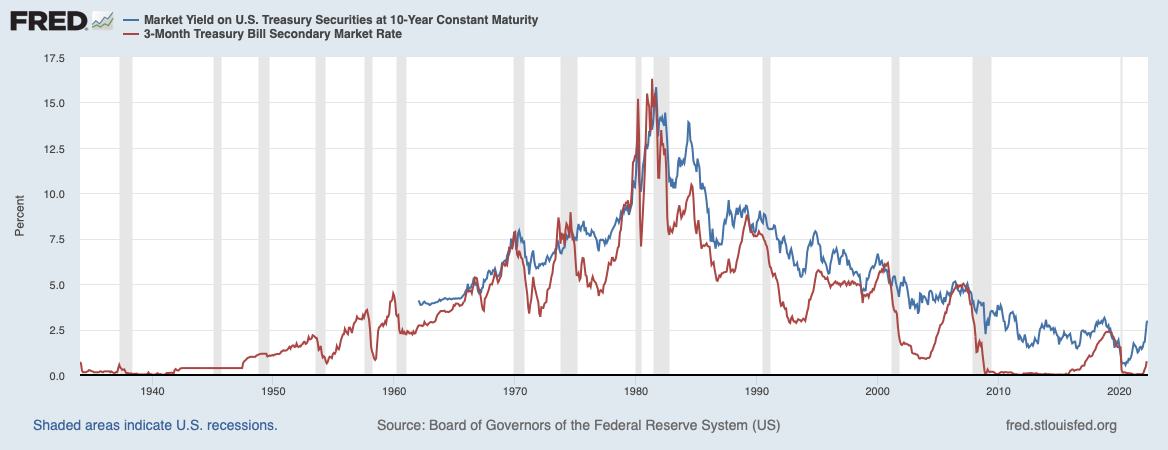

Our Finite World The years between 1981 and 2020 were very special years for the world economy because interest rates were generally falling:

In some sense, falling interest rates meant that debt was becoming increasingly affordable. The monthly out-of-pocket expense for a new $500,000 mortgage was falling lower and lower. Automobile payments for a new $30,000 vehicle could more easily be accommodated into a person’s budget. A business would find it more affordable to add $5,000,000 in new debt to open at an additional location. With these beneficial effects, it would be no surprise if a debt bubble were to form.

With an ever-lower cost of debt, the economy has had a hidden tailwind pushing it long between 1981 to 2020. Now that interest rates are again rising, the danger is that a substantial portion of this debt bubble may collapse. My concern is that the economy may be heading for an incredibly hard landing because of the inter-relationship between interest rates and energy prices (Figure 2), and the important role energy plays in powering the economy…