This begins our seeing the details of the mechanics, as Qanon often states,

“They want us divided.”

It is true and we sat idle while our government ran amok.

We are told by both major American political parties that our “social reforms” of the 1990’s are a success, because there are less people on the welfare roles today. Although some of that is correct, the whole story depicts the greatest sociological disaster in the history of humanity. This debacle was indeed purposely inflicted upon us by the criminals we elected into office at all levels of government.

This series will examine many great deceptions. Among them is how the monetary subsidizing of single parent households, through any method, will have an equal or even greater negative impact upon marriage, birth rate, enlistment and retention in the military, and survival of a society. Whether is it through welfare systems, child support or spousal support/alimonies/pendente lite the end results are likely to be the same.

Through waste, fraud, gaming the system and blatant violations of the very federal programs that funded marriage protection and incentive, responsible fatherhood, safe families, and many of the other social policies, our states unleashed a reign of terror on marriage and against parents in general. This has gone on unchecked for decades.

The Heritage Foundation, long time critics of public assistance programs, contend that; “…welfare payments do not assist children; they increase dependence and illegitimacy, which have a devastatingly negative effect on children’s development.” (See: How Welfare Harms Kids).

Despite spending billions of dollars for social programs depicted to promote and preserve marriage and sponsor personal responsibility and accountability, our nation’s level of out-of-wedlock births continually escalates to new record levels, child support arrearages increase, and our divorce rate remains at near record levels. We aren’t ruined yet, but the two parent household is at risk and remains near record lows (See: The Majority of Children Live With Two Parents, Census Bureau Reports).

Though the assault on the family has not let up. The biennial reports “Custodial Mothers and Fathers and Their Child Support” (1999, 2001, 2003, 2005, 2007, 2009, 2011, 2013, and 2015) from the US Census Bureau show the continuing increase of children living in single parent households. We are now past the 25 percent point of children with only one parent. And from an 88 percentage of two parent households to 69 percent.

How and why did this happen and proceed with such great predictability?

Our federal and States’ family law statutes were never intended to dispense justice or operate in “the best interest of the child.” Nor do they execute the true governance over the daily operations of their courts. Conversely, the states’ family law statutes are designed to ensure the operations of their family courts leverage the maximum return from an array of federal grant sources, often at the expense of the best interest of the child. Many of the federal programs providing the grant money to their family law operations are major parts of our failed welfare reform effort.

The legislatures of most of our states have abnegated their authority over the operational guidelines of their courts to committees ruled by their Supreme Courts. These committees produce and manage the states’ courts guidelines, rules and the procedures that govern the day-to-day operation of the state’s family courts and that of the court personnel and, in effect, the attorneys practicing within them.

As we know the separation of powers forbids our courts to legislate. So the guidelines, rules and procedures that govern our courts operation aren’t actually laws. But they do have the full effect and force of law.

To be certain nothing can stop this feeding frenzy off the federal teat, the states have excluded the operation of the courts from their respective Sunshine Laws. So their citizens can not find out in advance what they are planning to do in the next revision. They have no say in the matter except after the fact, which for all practical matters is no say at all.

We see this methodology proceed at the state and federal level. Which has, in effect, eviscerated the representative process. It has been a long time since our legislatures have done their jobs. Mainly because we have failed to do our primary job; the oversight of our government.

This is among the prominent ways the Deep State divides us. By bribing half the population to financially destroy the other half. While enriching the bureaucrats and elected officials (and their elitist sponsors).

Since the adoption of the laws in the 1990’s collectively known as “welfare reform,” Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA – Bill Text) and its repulsive siblings which include, Temporary Assistance for Needy Families (TANF – Bill Text) and the Child Support Performance and Incentive Act (CSPIA – Bill Text), the states have adopted a mindset of taking as much money as they can from their citizens who are almost always parents of minor children. This lets the states suck as much from the federal coffers as possible.

The fundamental attack feature of this array of statutes is found in its core concept of basing the federal incentives under these laws primarily on the amount of money the states collect in child support. Not primarily on the percentage of cases they successfully collected. This is covered in the 2014 report by Ed Gerrish of Indiana University, titled, “The Effect of the Child Support Performance and Incentive Act of 1998 on Rewarded and Unrewarded Performance Goals.” (free subscription required).

In Garrish’s work he cites (Holmstrom and Milgrom 1991) 1 noting, “…which individuals expend effort on rewarded activities and ignore or otherwise slack on unrewarded activities.” Exerting greater efforts where the greater rewards exist (a.k.a. “gaming the system”).

Since the welfare reform laws were enacted we have seen some horrifying results. Not the least of which is how the national level of child support arrearages has grown from being less than ten billion dollars when welfare reform was first debated in the US Congress in the mid 1990’s to well beyond one hundred billion dollars today (2016 arrears: Annual Report To Congress Fiscal Year 2016, see Page 227, Table 85).

Worse yet, the Department of Health and Human Services’ Office of Child Support Enforcement (OCSE) shows that currently the average income of an obligator with high child support arrearages is less than ten thousand dollars a year. So despite popular fiction the fact is that the average so called, “dead-beat-dad” isn’t driving on the beach in a Porsche with their teenage trophy wife while their children starve with their abandoned ex-wife. They actually meet the financial qualifications to apply for public assistance or disability themselves and should be called, “Dead-Broke-Dads.”

The truth is, less than 4% of support arrearages in the United States are owed by child support obligators who earn more than twenty thousand dollars a year. The fact is, child support arrearages are largely a byproduct of poverty and disability. But these facts don’t support narrative that promotes divisiveness between the genders; the real goal of the Deep State.

The other side of dividing our families and children from parents is time based. The custodial parents’ child support is based on three things, the custodial parent’s wages/wealth, the non-custodial parent’s wages/wealth and what the time share of the child is. Within that time component is an item known by many as, “The Hinge Cliff.” This is the point where a slight change in the time ration the non-custodial parent gets with their children results in a substantial change in their child support obligation.

Here are two quick samples made from North Carolina’s child support calculator. In the first set of examples we will be using a 2-child model where both parents are working with equal incomes.

For speed and clarity of the impact parenting time has on the child support obligation only the parenting time factors will be modified and all other details are static. In all the first example the gross incomes of both parents will $4,000 per month.

Non-Custodial Parent (NCP), Custodial Parent (CP)

With the NCP’s time is 0% the child support obligation = $618.00

With the NCP’s time equal to 20% (73 overnights) the child support obligation = $618.00

With the NCP’s time equal to 30% (109 overnights) the child support obligation = $618.00

[The Hinge Cliff]

With the NCP’s time equal to 35% (128 overnights) the child support obligation = $276.00

With the NCP’s time equal to 40% (146 overnights) the child support obligation = $186.00

With the equal parenting time (182 overnights) the child support obligation = $2.00.

Note: 100% equal parenting time would be 182.5 overnights and would result in a $0.00 child support obligation, but NC calculator does not accept half days.

The next set of examples uses a 2-child model where both parents are working with the NCP having double the income of the CP. The monthly incomes used are; NCP = $4,000, CP = $2,000.

With the NCP’s time is 0% the child support obligation = $758.70.

With the NCP’s time equal to 20% (73 overnights) the child support obligation = $758.70

With the NCP’s time equal to 30% (109 overnights) the child support obligation = $758.70

[The Hinge Cliff]

With the NCP’s time equal to 35% (128 overnights) the child support obligation = $539.00

With the NCP’s time equal to 40% (146 overnights) the child support obligation = $455.00

With the equal parenting time (182 overnights) the child support obligation = $287.00.

The less time the Non-Custodial Parent gets with their children, the greater their child support obligation gets. And the higher the award is to the Custodial Parent and the more incentive monies the states and counties yield.

This shows why it is in the states’ and their counties best interest to see to it that the parent with the highest earnings does not get custody of the child and the time the Non-Custodial Parent gets with the children stays below 30%.

This has resulted in widespread “time struggles” between parents and an untold number of ex-parte restraining orders on behalf of dependent children to keep the Non-Custodial Parent’s time to a minimum. False claims of domestic violence are the most common method used to help the one parent get custody and leverage the greatest levels of child support by reducing the time with or even keeping the Non-Custodial Parent from ever seeing their children.

The courts even train attorneys on how to maximize the monies in divorces and custody cases. Notwithstanding the fact that the collusion in doing so could make the defendant the only innocent person in the courtroom. The following video covers in detail what the attorneys are taught and how many felonies they and the court are committing. Including the conspiracy they just created in the training.

Video from DDJ at Misandry Today.

All of the above the facts align perfectly with the Deep State’s agenda to destroy the family. Enriching the government employees and bribing half the parents into doing their dirty work for them. All with our own tax dollars.

Among the battery of “laws” the states’ court committees create, child support guidelines are their big cash cow. Also, beyond its own funding, false domestic violence claims are proven to open the door to even more child support per case and many other funding sources unrelated to domestic violence. As shown in the video above.

Not only are the states paid for collecting or not collecting child support, those performance figures also play a major role in how much TANF grant money they receive. Read through TANF sometime, you may be shocked to learn that a large portion of those law’s dialog are covering when and where the states can spend their welfare incentives on highways other non-direct TANF projects.

However, we don’t call it highway funding in this case. That spending is classified within a category called “improving access to welfare and court facilities,” which is a perfectly legal and legitimate application of TANF incentives. This spending is then applied toward the state’s percentage of welfare incentives spent on “assistance related programs.” The level of which are mandated by the federal programs funding guidelines.

The important point here is that if the state needs more highway funding, all they need to do is raise the state’s level of child support by reducing the time Non-Custodial Parents have with their children. Then they can spend their resulting welfare and child support incentive increases on highway projects and remain in perfect compliance with the relevant programs funding requirements.

In view of the fact that the states child support and welfare incentives are largely based on the child support money on their books, they need to figure out how to get the most money per case out of people. A quick overview of the construct of child support guidelines shows us that in every state child support awards are predominately based on three considerations:

1) Income of both parents – and the difference between them

2) Child care costs of both parents – and the difference between them

3) The amount of time each parent has the child – or the difference between them

The parents’ income is not something the state can control (or legally change), neither are the care costs the parents have, they are pretty much what they are. So the only thing the state can control and manipulate is the time the parents have with the child. We call this “custody and visitation.”

If you search the web you will be able to find online child support calculators for every state. Experiment with some example cases for yourself. What you will find is that the time the parents have with the child has the single greatest impact on a child support obligation of the three main considerations.

At many income levels the difference between 50/50 (equal) parenting time and 70/30 will result in twice the child support being awarded to the custodial parent and can double again if the time the non-custodial parent has with the children is less than 85/15 (or less in some states). You can be assured that this is no accident.

If any doubts remains that family law is based on dollars and not on equal justice under the law, or the best interest of the child, ask now US Senator and former North Dakota Governor, John Hoeven. Mr. Deep State himself.

Among the typical items on the ballet in 2006, North Dakota had ballet item for “Presumptive Equal  Parenting” (it would end the Hinge Cliff battle in ND). Then Governor Hoeven himself spoke out against this ballet initiative. Not for the welfare or well being of his state’s children.

Parenting” (it would end the Hinge Cliff battle in ND). Then Governor Hoeven himself spoke out against this ballet initiative. Not for the welfare or well being of his state’s children.

Rather than defending the well being of his state’s children, then Governor Hoeven’s stated reason for opposing this Presumptive Equal Parenting was due to the hundreds of millions of dollars in federal grant money such a law would cost North Dakota. That, by the way is a significant portion of most states’ expected annual revenue and revenue that is considered greatly in the state’s budget requests.

Then Governor Hoeven did this even though he was informed numerous times that scientific studies clearly showing children in equal parenting arrangements after a family breakup excel at almost the same levels as those in intact, healthy families with both their biological parents present. He was also made aware that the large majority of teens in juvenile detention, who become pregnant, smoke, run away, do drugs, and other social problems are in primary custody arrangements.

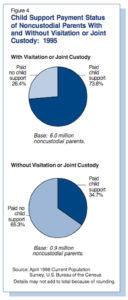

Then Governor Hoeven was also aware that in the biennial reports “Custodial Mothers and Fathers and Their Child Support” (1999, 2001, 2003, and 2005) the US Census Bureau reports that parents with equal parenting arrangements are far more likely to pay their child support, in full and on time without any enforcement actions then any other parenting arrangement. Where parents who have limited, disrupted, or no visitation with their children are likely not to pay a cent.

Based on then Governor Hoeven’s own commentaries, it is clear that his decision was not based on the best interest of the child or family values; it was all about the money.

It is important to note that the states actually have no legal requirement to do what is required of most of the federal incentive programs. Those requirements are only applicable if the state wants to apply for the federal funds a given program provides. Making the choice to destroy families and parenthood for the money is a conscious one. Doing so sells-out our state sovereignty and drives our nation rapidly towards a centralized Socialist system of government. Another key Deep State, Globalist goal.

All of the family law actions in our county courts yield federal incentive moneys for the state, including domestic violence orders. It is a long established fact that there is no faster way to reduce a parent’s visitation time than a claim of domestic violence, plus everyone involved gets paid even more. This includes both parties’ attorneys who now are handling the domestic violence cases in addition to the divorce and custody issues.

Moreover, it should be no surprise that no one will stand up against a false allegation of domestic violence, except its victim. Even when everyone knows for a fact the putative victim’s claim is completely fabricated or they openly admits to the court that it is a false claim the orders are often issued anyway. It is no wonder divorce attorneys are eager to tell their clients in divorce cases to file claims of domestic violence and include the children in the claim. While this dynamic is one of the primary reasons the MGTOW movement has grown so quickly.

So long as federal child support incentive programs pay the states based on the dollar values of a case, instead of the same incentive level per successfully collected cases, no matter what the dollar value is this is the way it is going to be. Middle class families will be destroyed while the poor will continue to be abandoned. Nothing about this sounds like a public assistance program, does it?

Currently, despite the established scientific facts that children do better with equal access to both of their parents. And the most effective and cost effective method of child support enforcement is enforcing custody and visitation, federal incentive programs under our failed welfare reform are paying our states and their employees to limit the time children spend with one of their parents.

Though abolishing No Fault divorce would surely stem the tide of divorce mania and force parents to think of their kids first. Children need parents, not divorce divas and visiting dads.

This is the first of a series where we dissect the federal statutes. Qanon warns us often that, “They want you divided.” This is one example of how they have been getting us to destroy each other. We need to find the rest of these traps in the federal and States’ statutes and make our elected officials make the needed changes to end this.

Reference:

1 Holmstrom, B. and Milgrom, P. (1991). Multitask Principal-Agent Analyses: Incentive Contracts, Asset Ownership, and Job Design. Journal of Law, Economics & Organization, 7:24–52.

Cheers, anon

Previous: Qanon and Our Personal Fight For The Survival of Humanity

Next: Qanon and How the Deep State Tried To Destroy Us With Our Own Laws (Part 2)

Best what can be in the world is Family !