by TYLER DURDEN

The Dow and S&P 500 suffered their worst ‘Black Friday’ selloff in 70 Years

Arriving just in time to lower gas prices at the pump and dampen down the roaring inflationary impulse that could force The Fed’s hawkish hand, COVID variant ‘Omicron’ strikes:

The timing does seem a little convenient…

— Stalingrad & Poorski (@Stalingrad_Poor) November 26, 2021

And between that and the generally low levels of liquidity on this half-day holiday, markets turmoiled dramatically.

Today was the worst daily drop for WTI since June 2020 (when WTI went negative) and it broke below its 200DMA…

Before today, Brent had only fallen 10% or more on a single day in 14 occasions since the futures contract was launched more than three decades ago.

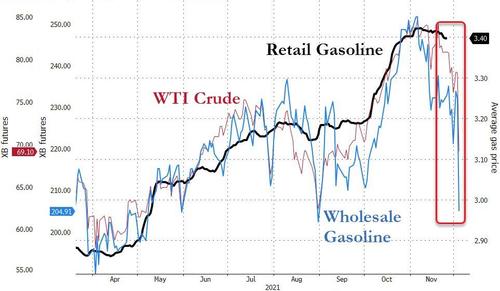

And that crash should lead gas prices at the pump significantly lower…

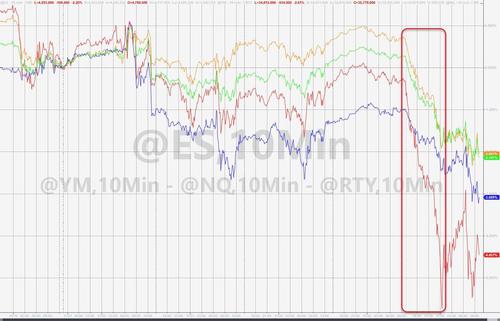

Stocks were crushed overnight with Small Caps leading the collapse (down over 5%) before the standard algo-driven ramp lifted everything into the US open. A big wave of selling hit the market then and continued accelerating back to the lows of the day into the European close.

It looks we bottom-ticked today’s trade with this tweet…

"Start buying. We are about to leak the all clear" pic.twitter.com/55HV35eon0

— zerohedge (@zerohedge) November 26, 2021

Today was Russell 2000’s worst day since June 2020. The Dow had the worst day since October 2020. S&P and Nasdaq both suffered its biggest daily loss since September 2021

On the week, all the US majors were in the red with Small Caps underperforming…

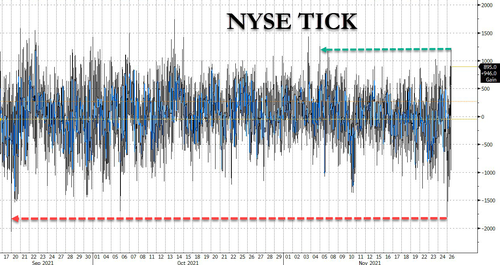

It was a crazy day: in the span of 3 hours we got the biggest sell program since Sept 20 and the biggest buy program since Nov 3

Source: Bloomberg

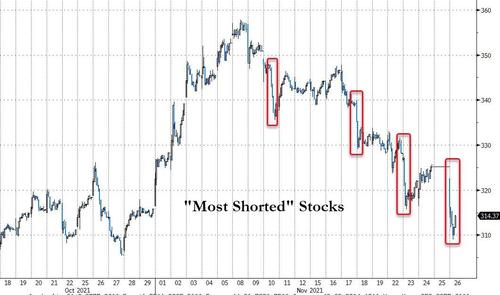

“Most Shorted” stocks plunged this week, back to one-month lows…

Source: Bloomberg

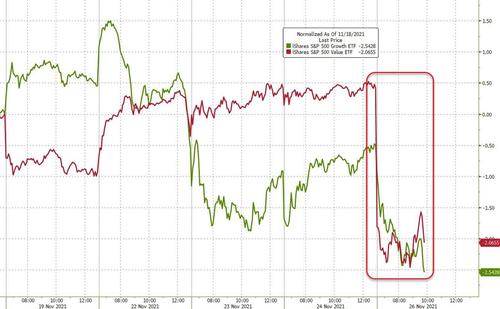

Growth and Value stocks were monkeyhammered on the week…

Source: Bloomberg

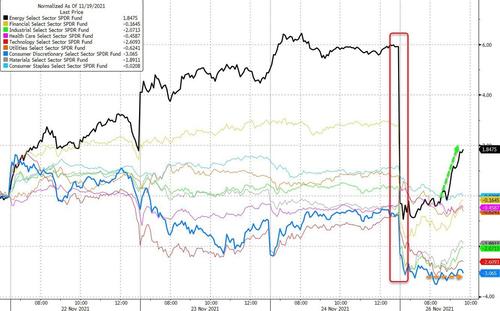

Despite the bloodbath in energy today, energy stocks were the only ones to end the week green…

Source: Bloomberg

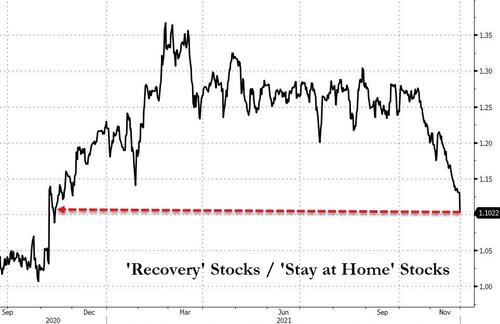

“Stay at Home” stocks surged relative to “recovery” stocks today. Recovery stocks are at their weakest vs ‘stay at home’ stocks in a year…

Source: Bloomberg

VIX spiked dramatically today, blasting through 20 and topping 28 at its peak…

Oil vol exploded higher this week, along with equity vol…

Source: Bloomberg

Credit risk surged today. IG spreads spiked to the highest (worst) level since March, HY is trading at its highest spread in a year…

Source: Bloomberg

HYG is massively diverging from stocks…

Source: Bloomberg

Treasury yields plunged today, dropping 12-16bps across the curve…

Source: Bloomberg

30Y Yields tumbled back below 2.00% and are near 3-week lows…

Source: Bloomberg

Breakevens crashed back to FOMC statement levels…

Source: Bloomberg

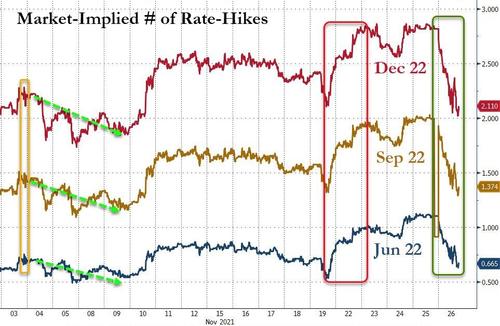

And STIRs sent rate-hike odds reeling…

Source: Bloomberg

The dollar ended the week higher, despite selling pressure today. Today was the biggest dollar drop in a month..

Source: Bloomberg

Crypto markets were clubbed like a baby seal today, pushing all the major coins into the red on the week…

Source: Bloomberg

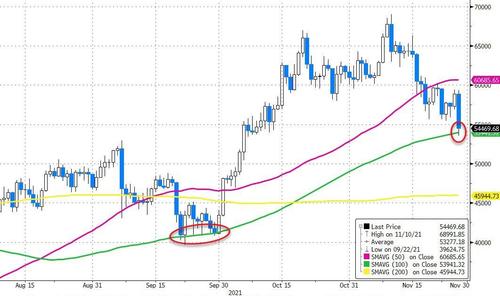

Bitcoin puked back below $54,000 and found support at its 100DMA…

Source: Bloomberg

Gold surged as the chaos began but as we approached the European close, a wave of selling hit sending the precious metal back below $1800…

Gold is trading right at the confluence of its 50-, 100-, and 200-DMAs…

Source: Bloomberg

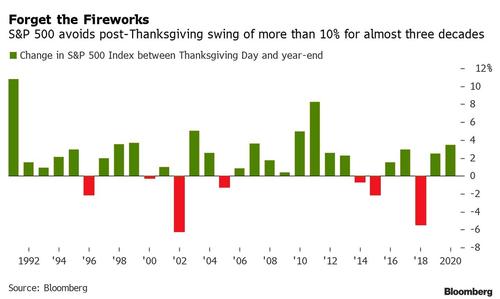

So, finally, what happens next? Anyone looking for U.S. stocks to provide year-end fireworks is likely to be disappointed, if history is any guide. The S&P 500 Index’s most recent move of more than 10% between Thanksgiving Day and the end of December occurred in 1991, according to data compiled by Bloomberg.

In the past three decades, the S&P 500 rose 1.8% on average in post-Thanksgiving trading.

The index posted gains 23 times during the 30-year period.

As Peter Schiff noted, “The Fed no longer has the ability to stimulate the economy by creating #inflation. Instead of QE and ZIRP making people wealthier by pushing up asset prices, it now makes them poorer by pushing up consumer prices instead. Monetary stimulus has become a sedative. It’s game over!”