by TYLER DURDEN

Despite the recent jump in Delta variant covid cases in the US, economic data continues to show that consumers are actively spending on services and remain undeterred despite the media’s best efforts to spark a fresh pre-lockdown panic.

First, a quick update on the current state of the virus in the US.

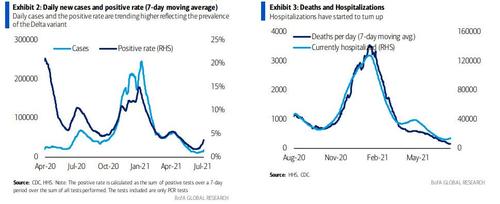

Average daily virus cases jumped by 28.3% to 17.4k during the week ending July 9, and the 7-day moving average of virus cases increased to 17.4k during the week ending July 9. This is the highest level since May 31 and a 28.3% increase from the week ending July 2. As BofA note this morning, from July 2 to July 9, forty states have recorded growth in daily cases and states where vaccine rates are lower are experiencing faster case growth. As shown in the chart below, the bank finds that growth in virus cases and vaccination rates at the state level exhibit a negative relationship.

Along with low vaccine rates, the Delta variant, which is more infectious than earlier strains, has driven the rise in cases of late. Outbreak.info estimates that the variant accounted for 20% of virus cases over the 60 days ending July 7.

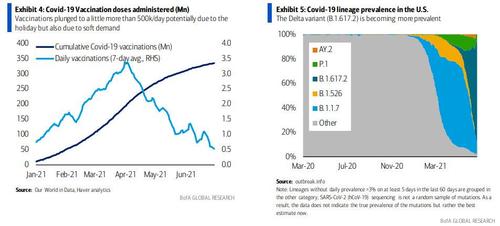

Meantime, vaccine rates have slowed appreciably with the 7-day average of jabs dropping to just about 500k. This was likely due in part to the July 4 holiday; however, shots have been on a downward trend since April.

Regardless, the US remains one of the most vaccinated countries, with 67.7% of its adult population and 88.7% of those 65 and older having received at least one shot to date. This, BofA concedes, should limit the spread of the Delta variant. However, the bank warns that the uneven vaccination rates across states and within states means that there are areas that have little protection against this highly infectious variant. Moreover, the longer the virus lingers the greater the risk for a vaccine-resistant variant to develop. In short: whether be decree or due to simple population dynamics, Covid-19 could be with us for the foreseeable future.

In light of this data, BofA thinks we will continue to see a surge in cases over the near-term, but does not expect restrictions on activity to be broadly imposed again. This means that while the downside risk to the economy is relatively low, the bank’s economists will continue to reevaluate this view as things can change in a matter of days when it comes to the virus.

Economic activity

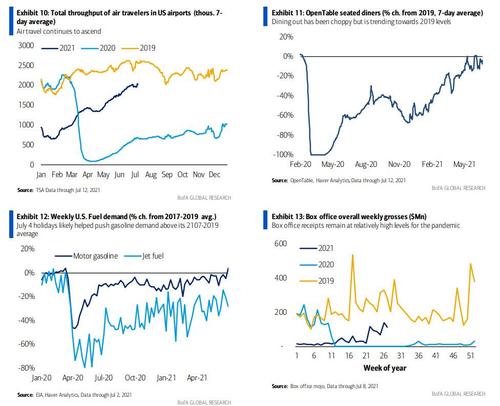

The NY Fed weekly economic index came in at 9.8% yoy in the week ending July 10, down a bit the 10.0% reading in the prior week. Looking at 2Q, the weekly index from the Fed predicts 2Q growth of 11.1% yoy, which would imply 2.9% qoq saar. This would be a significant deceleration from 6.4% in 1Q and is below current consensus forecasts of 10.0% qoq saar or 13.0% yoy. That said, the NY fed index has tended to undershoot actual growth.

Consumer activity

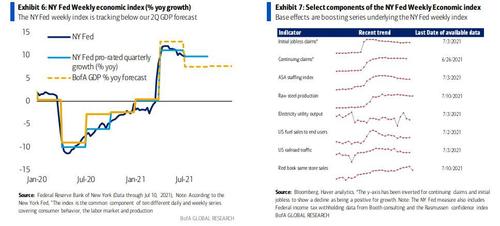

According to BofA, consumers’ appetite for services has so far been undeterred by the rise in cases. Dining out and air travel both increased by 1.2% and 2.9% respectively during the week ending July 12. Movie box office receipts also remained elevated as F9: the Fast saga was the top earner for a second consecutive week. Here are the details:

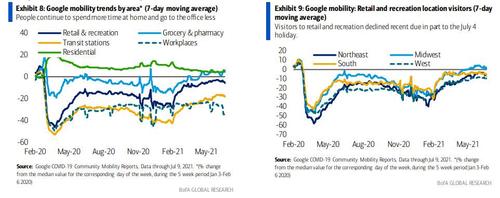

- Time spent at home increased during the week ending July 9 given the July 4 holiday. Similarly, visitors to parks surged by 15.7% over the week and visitors to workplaces fell 7.7%. That said, one should ignore these big moves due to the holiday.

- The 7-day average of daily air passenger traffic increased by 2.9% to 2.032M during the week ending July 12. This was 79.3% of traffic during the same week in 2019, down from 81.1% in the prior week. Leisure travel has rebounded quickly, while corporate and international travel continue to lag. That said, BofA strategists noted that corporate travel is trending higher. International travel remains depressed, and the Delta variant is likely to keep a lid on international travel for the foreseeable future.

- Seated diners on the OpenTable network were down 7.8% from 2019 during the week ending July 12. This was up 1.2% from the prior week as weekly increases in the South and West offset declines in the Northeast and Midwest. We continue to expect dining out to approach 2019 levels, but nascent concerns over the Delta variant could start to affect consumers’ willingness to ear out even if they are vaccinated.

- Motor gasoline demand for the week ending July 2 topped its 2017-2019 weekly average for the first time since the start of the pandemic. This was likely due in part to seasonal effects from the holiday.

- Movie box office receipts remained elevated but declined from last week’s pandemic high. Receipts fell to $115M from $140M with F9: The Fast Saga remaining the number 1 release. Average receipts per film are running above pre-pandemic levels due to the limited number of movie releases. This suggests demand is strong but supply has some catching up to do.

Labor market

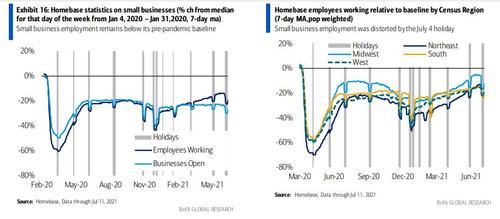

- The employment data tracked by BofA continues to be affected by the holidays as data from Homebase and the American staffing index are only available through July 11 and 3 respectively. Here are some more details:

- The data on small business employment from Homebase remains affected by the July 4 holiday as the latest available data are only through July 11, and we look at the 7-day moving average to smooth through week-day noise. Next week the data will be more informative as we’ll have the first estimate of the employment figures for the July payroll week.

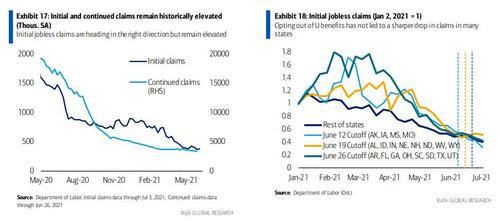

- Initial jobless claims were little changed at 373k in the week ending July 3rd. It’s possible the holidays added a little noise to the data and could also distort the coming release. Additionally, auto companies forgoing typical summer production slowdowns could also affect the data.

- Through the first 27 weeks of the year, high propensity business applications are up 40.5% from the same period in 2019. This should be a positive source of labor demand over the near-term as new businesses start hiring. Additionally, it could also help drive productivity.

- The American Staffing index recorded an 8.4% increase from two years ago during the week ending July 3rd. It’s likely that the outsized increase is a result of the timing of the July 4 holiday in 2019 vs. 2021. That said, the index continues to be a positive signal for labor demand and hiring activity in the temporary help sector.

Industrial activity

- Railroad traffic rebounded with and 10.9% increase during the week ending July 3, more than reversing the 5.0% drop in the prior week. The rebound was driven by a surge in carloads of coal, motor vehicle and parts, and chemicals.

- In the week ending July 3, raw steel production rose by 1.0% and was little changed in the week ending July 10. It is currently now just 2.3% shy of its pre-pandemic average.

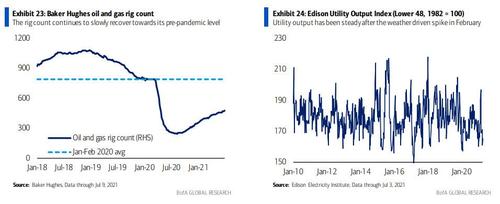

- The oil and gas rig count increased by four to 479 during the week ending July 9. Two of the four new rigs were oil rigs, bringing the count up to 378. This is well below the pre-pandemic average despite oil prices running at elevated levels on the back of strong demand.

Real Estate

- Mortgage purchase applications continue to slide, declining by 1.1% in the week ending July 2. Limited supply continues to be cited as a key reason for the decline in sales, although the real reason is soaring prices and lack of affordability. Still after being a strong positive early on in the pandemic recovery, the residential sector is becoming a drag on growth.

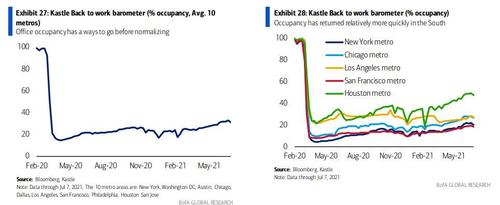

- Office occupancy levels fell during the week ending July 7 due to the July 4 holiday. Across 10 major metro areas, average office occupancy fell by 1.7ppt to 31.0%. This is likely to reverse in the following week as the holiday effects fade.

In short, the media is doing all in its power to drum up panic for what appears to be another upcoming stimmy-triggering lockdown, but at least so far it is failing to impact consumer behavior.