by TYLER DURDEN

Some US companies have switched their production model from just-in-time (JIT) to just-in-case inventory (JICI), a more suitable model in today’s challenging supply chain environment. JICI allows companies to store more inventory and will help ensure future orders are filled. But a new problem is emerging with JICI, one where companies might order too much merchandise and spark gluts.

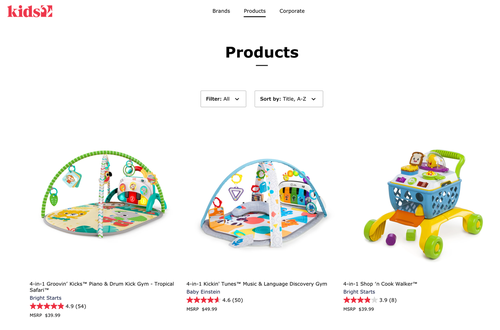

“Customers are just flinging crazy orders right now, so it’s hard to determine the real level of demand,” Ryan Gunnigle, CEO of Kids2, an Atlanta-based toy company, told Reuters. He said a top risk to his businesses this year is overordering toys for the holiday season, resulting in high inventories once the supply chain eases.

Companies, with manufacturing plants in China and elsewhere, have adjusted to JICI because they worry about running out of goods before stocks can be replenished. This creates the problem called the “bullwhip effect.”

Gunnigle said a decline in shipping container prices is one of the first signs of easing supply chain issues. We pointed out on Oct. 4 that container rates between the US and China hit a wall of resistance.

“We’re starting to see things flow a little bit easier,” he said, adding that “curve balls keep coming.”

One of the latest disruptions has been the energy crunch in China which Gunnigle said he recently learned one of his factories was halted due to power issues. He also noted the cost of plastics and other materials have gone through the roof.

Gunnigle noted his company doubled down in on China production with a new factory complex while other companies have exited the country and set up shop elsewhere. He said this has helped with lead times as opposed to competitors.

“I think our response time has been a lot better than our competitors because of that,” he said, noting that as early as May, Toys2 added up to two-and-half months to the time it expected to receive goods from China – on top of the normal average of 70 days.

“We’ve really padded our lead times,” he said. “Not just in manufacturing – but in our estimates of the time it takes to get to the port, get things on boats, time to unload the boats.”

Gunnigle said he is carefully observing the risk of oversupply:

“There’s a lot of inventory in the pipeline,” he said. “I just want to make sure we don’t get stuck with too much.”

He warned that increased congestion continues to pile up at Southern California ports, and bottlenecks may worsen in China by the end of this year or early next, “because containers on the West Coast and East Coast are not being returned to China fast enough to replenish goods coming from China to support Q1 demand.”

Ordering too much could be the next big headache for US companies if supply chain stress continues to ease.