By Tyler Durden

With Chancellor Angela Merkel’s 16-year reign set to conclude following this weekend’s German federal election, the broader German political landscape is about to change for the first time in two decades.

And with Merkel’s dynastic CDU/CSU continuing to slide in the polls, a situation that we first sketched out four weeks ago remains likely: a party that has ruled Germany for 50 of the past 70 years and began to see the chancellery as its natural birthright is now facing the real prospect of being booted out of power.

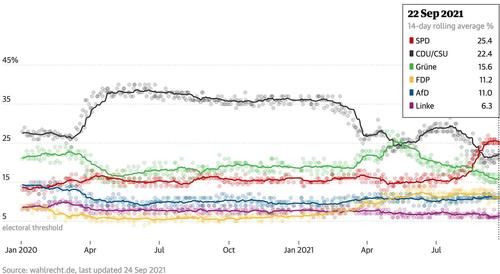

The latest polls show the CDU/CSU in second place behind center-left rivals SPD. But even more concerning (particularly for the country’s wealthy) are the gains being made by the greens, and a far-left party known as Die Linke, the ideological and political heir to the East German socialists who ruled over East Germany during the cold war. To the CDU/CSU, these far-leftists are just as unpalatable as the AfD, a stridently right-wing party that has been the most successful right-wing movement in terms of its representation in the Bundestag.

Source: the Guardian

But increasingly, the CDU’s Armin Lascet, the candidate running to succeed Merkel from her own party, has pressed the Social Democrats and their candidate, Olaf Scholz, to pledge not to form a coalition government with Linke, with whom the SPD is probably closer in terms of policy than the pro-business Free Democrats, according to Reuters.

Per a different Reuters report, few expect this to happen – the Linke are polling at just 6%, half the liberals’ 11%, which probably wouldn’t be enough to give Scholz the required parliamentary majority. But for some investors, it is a risk that should not be overlooked. “Inclusion of the Linke in a governing coalition would, in our minds, represent the single biggest wild card by far for financial markets from the German elections,” said Sassan Ghahramani, chief executive of U.S.-based SGH Macro Advisors, which advises hedge funds.

Still, for the wealthy and the investing class, it’s a risk that shouldn’t be overlooked.

“Inclusion of the Linke in a governing coalition would, in our minds, represent the single biggest wild card by far for financial markets from the German elections,” said Sassan Ghahramani, chief executive of U.S.-based SGH Macro Advisors, which advises hedge funds.

Which is why thousands of wealthy Germans are scrambling to stash their wealth in Switzerland ahead of the Sept. 26 vote, according to Reuters.

If the center-left Social Democrats, hard-left Linke and environmentalist Greens come to power, the reintroduction of a wealth tax and a tightening of inheritance tax could be on the political agenda. “For the super-rich, this is red hot,” said a German-based tax lawyer with extensive Swiss operations. “Entrepreneurial families are highly alarmed.” What’s more, Linke policies such as a rent cap and property taxes for millionaires would be enough to spook many in Germany’s business class.

Specifically, the SPD wants to reintroduce a wealth tax and increase inheritance taxes, while the Greens (their most likely potential coalition partner) hope to tax Large fortunes more heavily. Although both envision raising income tax for top earners, a tax on assets would raise much more money, the tax lawyer said.

Most assume that a victorious Scholz – a strait-laced finance minister and a former mayor of Hamburg – would include the Free Democrats as a moderating influence in his coalition. Both the SPD and the Greens have ruled out working with any party refusing to commit to Germany’s commitments under the NATO military alliance, or Germany’s EU membership. Linke has questioned both.

But either way, the fear of a left-wing government, possibly one with links to Germany’s Communist Past, has shown just how many wealthy Europeans still see Switzerland as a safe haven for wealth, despite the country’s efforts to abolish its image as a safe haven for billionaires.

No country has more offshore assets than Switzerland. Inflows accelerated in 2020, to the benefit of UBS, Credit Suisse and Julius Baer. BIS data show deposits of German households and companies at banks in Switzerland climbed almost $5 billion to $37.5 billion during Q! of 2021. Note: this does not include shares, bonds or financial products. If we had to guess, that trend has likely continued as CDU’s lead in the polls has shriveled.

According to Reuters, more recent data aren’t available, but insiders say the inflows have continued: “I have booked an above-average amount of new money as in the past three months,” said a veteran client adviser at a large Swiss bank who deals mainly with Germans.

One wealthy manager described the trend thusly: “Many wealthy people, especially entrepreneurs, fear that there will be a lurch to the left in Germany – no matter how the elections turn out.” Another added: “I know a number of German entrepreneurs who want to have a foothold outside Germany if things get too red there”.