To paraphrase Milton Friedman, everywhere and always deflationary commodity outages and shortfalls are turned into general price inflation by the foolish monetary “accommodation” policies of the central banks. And the present pot-boiler inflation is no exception.

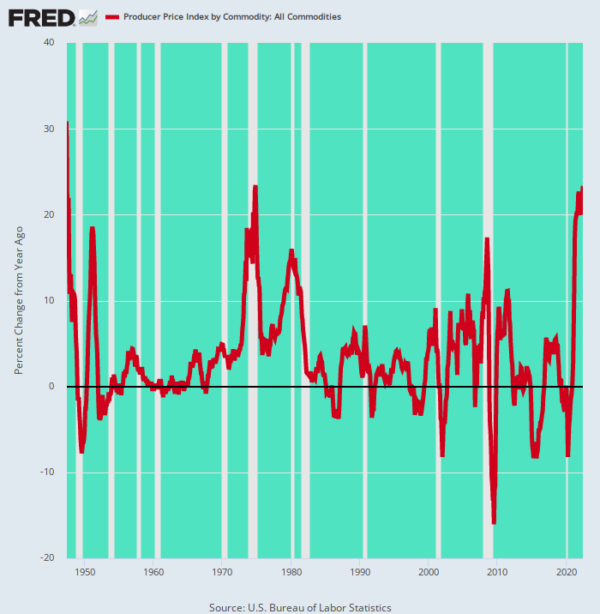

Y/Y Change In PPI for All Commodities, 1947-2022

There is no mystery as to how central banks got so far off the deep-end. In fact, it was Milton Friedman and his chief disciple, Ben Bernanke, who paved the way. It was they who instilled the wrong-headed fear of deflation among central bankers, culminating in the “lowflation” group-think that, in turn, fostered the rabid money-printing of the past decade, especially.

The fact is, when the cold war ended in 1991 and the Soviet Union was consigned to the dustbin of history, an unprecedented opportunity for a virtuous deflation was triggered. That is, vast swaths of mankind economically impaled in the former Soviet bloc and Red China were freed from the albatross of Marxist economics, thereby opening the door to a massive inflow of cheap labor into the globally traded economy—a secular shift that had the potential to substantially reverse the west’s great inflation of the 1970s…