By

THE SCENE

Almost a year after the failure of three midsized U.S. banks sparked an industry crisis, investors and regulators are once again bracing for turmoil among regional lenders, this time due to rising defaults in commercial mortgages.

The tipping point may be a Long Island lender, New York Community Bank, that reported major losses on its real-estate loans last week. NYCB’s share price has dropped 60%, dragging stocks of other regional banks down with it in an uneasy echo of last spring, when the government was forced to throw emergency lifelines to keep the system from toppling.

NYCB was initially a benefactor of those failures, scooping up Signature Bank last year after it was shut down by regulators following a run-on deposit.

KNOW MORE

The culprit now is commercial real-estate debt, which is souring quickly as landlords face higher interest rates than they can afford and tenants, after nearly four years of half-full offices, are cutting their leases.

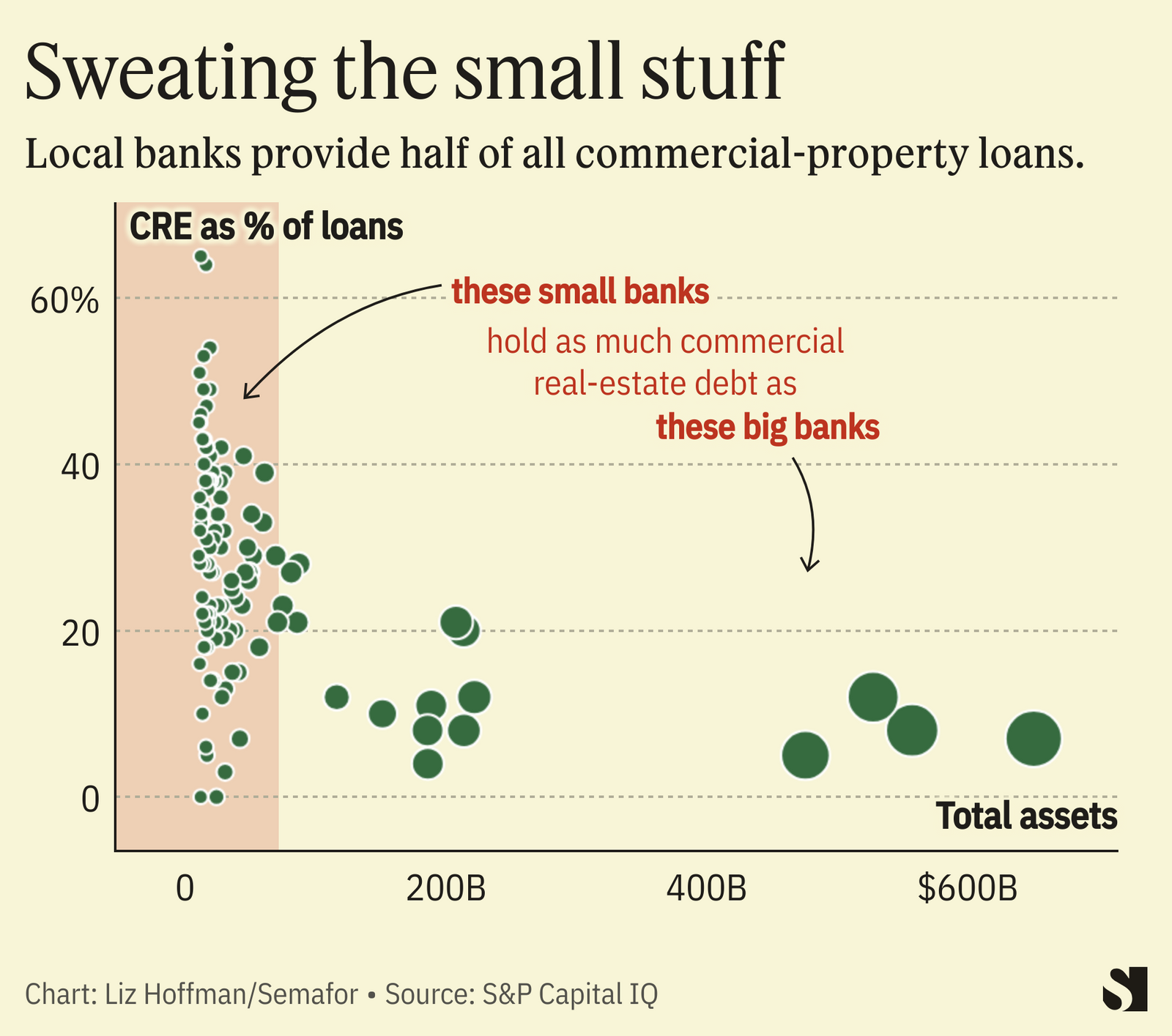

And while the U.S. banking system is increasingly dominated by a handful of national giants, commercial mortgages are still the province of regional lenders.

Commercial mortgages account for, on average, 3% of the assets at the 10 biggest banks in the country. At the next 150 banks, it’s almost 20%. Local banks routinely have half of their customers’ deposits tied up in mortgages for office buildings, hotels, and malls.

By NYCB’s own account, 44% of its entire loan book is mortgages to apartment complexes, half of that to rent-stabilized units whose landlords are struggling mightily as their own costs rise…

READ FULL ARTICLE HERE… (semafor.com)

Home | Caravan to Midnight (zutalk.com)

Be First to Comment