by TYLER DURDEN

We’ve been writing about the evolving global supply shock for some time (most recently today when we addressed what may be required to normalize the supply chain bottlenecks). And yet, every day we read about another dramatic commodity spike or factory shutdown.

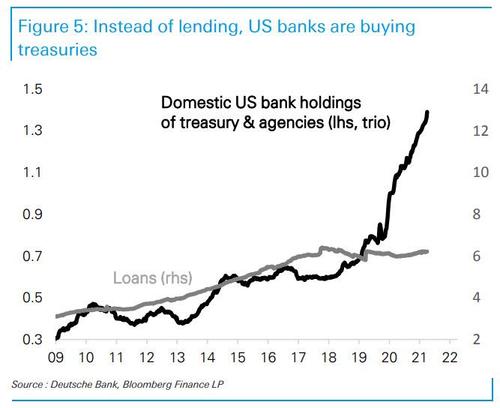

In a recent report from Deutsche Bank’s chief FX strategist George Saravelos, he discusses three sets of charts. They point to a “worrisome picture” where bottlenecks in one part of the economy are having a knock-on impact on another forcing further shutdowns. First, DB’s proprietary global shipping data is pointing to a very sharp slowdown in global trade. They also highlight the massive current and forthcoming demand for Treasuries from US banks, which is reflective of Saravelos’ previously discussed view of persistent excess savings and a low global r* (not to mention a Fed policy error).

This not only helps explain why global bond yields aren’t selling off more despite the dramatic inflation spike, but also why the US current account deficit and dollar did not deteriorate more sharply this year. Taking it all together, the DB strategist warns that “we may not be that far from the unfolding global supply shock entering a negative feedback loop with weakening demand.”

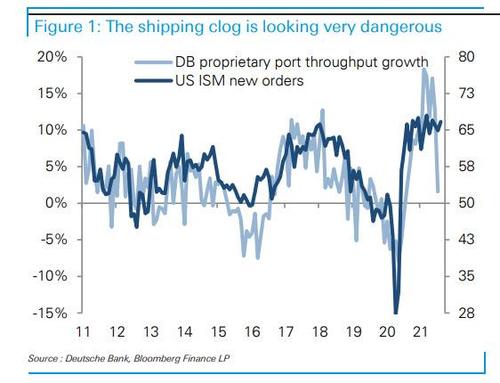

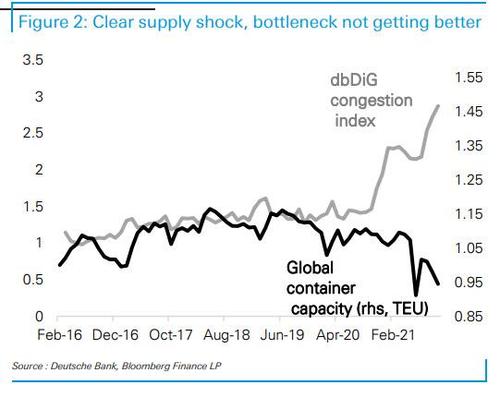

First, the FX strategist used the bank’s dbDIG team’s proprietary satellite/AI data which analyzes the movement of 100s of thousands of ships across the globe. It shows that the global shipping crunch is leading to a sharp slowdown in volume of goods going through ports suggesting material downside risks to the manufacturing cycle. The data also tracks shipping congestion and is showing that the logjam is the worst it’s ever been.

Finally, we can see that the primary problem here is not one of excess demand for goods but a breakdown in supply: global container capacity driven by supply chain disruption, has sunk to near-decade lows

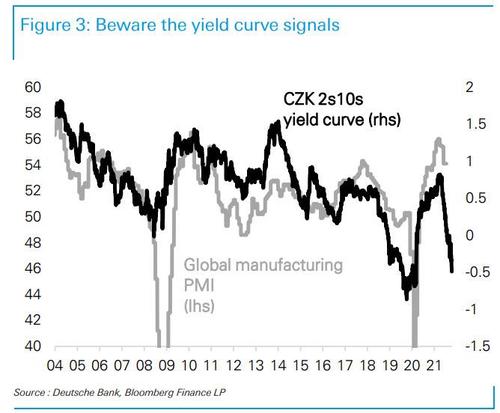

Second, Saravelos highlights how the fixed income market is already starting to price a recession in the Czech Republic where the yield curve has dramatically inverted. This is a worrisome development given Czechia’s tight links with global auto supply chains and is unsurprisingly also pointing to big downside risks to the global PMI

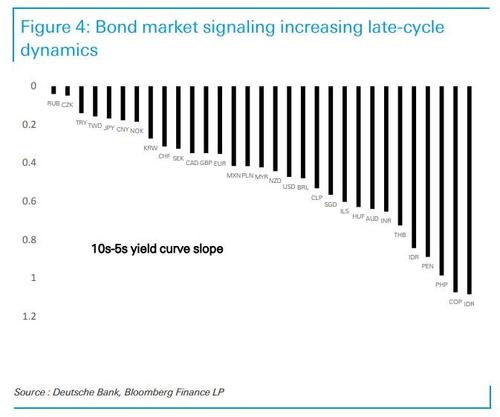

The DB strategist also ranks global yield curves by their flatness, and notes that much of the world is not that far behind from inverting

Finally, the macro read across of US bank earning results was fascinating. America’s largest bank is sitting flush with liquidity but rather than extending this to loan growth the dominant analyst question is when will this be used to buy treasuries. DB’s bank analyst thinks the bank is able to deploy up to $200bn in US security purchases in coming quarters, reflective of broader US bank holdings of government bonds that have taken off exponentially since the crisis began

In macro terms, Americans’ excess cash is not going into consumption but deposits; banks, in turn, prefer funneling liquidity back into the domestic bond market rather than extending credit as consumer demand for loans is not as attractive. This story fits in perfectly with why the US current account deficit has not widened more: US national saving rates remain too high. The US economy is proving more Ricardian or Japanese than thought.

Bringing it all together, the data remain on the pessimistic end of expectations in terms of the macro outlook. The aggressive flattening of curves in recent days is consistent with a view of a very low global r* and high excess savings interacting with an increasingly vicious negative supply shock (see here for more). As Saravelos concludes, “a poor structural growth outlook, too much saving over consumption and now rising inflation risks remain the dominant macro paradigm.”